At tonight’s TE School District meeting (7:30 PM, Conestoga High School), the school board will vote on the 2016-17 final budget and property tax rate.

In January, the board had adopted the preliminary budget which contained a 4.3% tax increase – they approved the budget with the Act 1 Index of 2.4% and allowable Act 1 Exceptions of 1.9%. At the April 25, 2016 regular school board meeting, the proposed final budget reduced the property tax rate from January, from 4.3% down to 3.875%.

According to the meeting agenda and budget materials (click here) the board will vote on the District’s 2016-17 final budget with an Act 1 Index of 2.4% and Referendum Exceptions of 1.2% for a 3.6% tax increase to the taxpayers.

The following chart shows TESD tax increases over the last twelve years. 2004-05 was the last zero tax increase year.

- 2015-16: 3.81%

- 2014-15: 3.4%

- 2013-14: 1.7%

- 2012-13: 3.3%

- 2011-12: 3.77%

- 2010-11: 2.9%

- 2009-10: 2.95%

- 2008-09: 4.37%

- 2007-08: 3.37%

- 2006-07: 3.90%

- 2005-06: 1.40%

- 2004-05: Zero Tax Increase

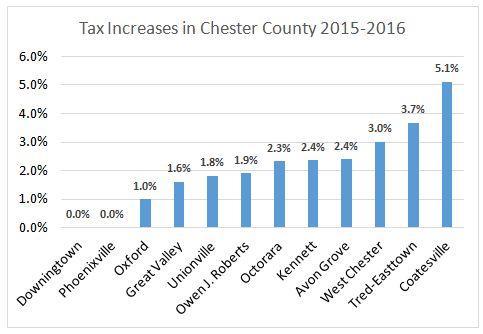

The TE School District residents can take solace that they are not alone in their tax increase. According to Adam Farence’s Daily Local article, 11 out of the 12 school districts in Chester County contain 2016-17 budgets with tax increases.

The only Chester County school district without a 2016-17 tax increase is Downingtown Area School District. DASD recently approved their 2016-17 budget with no tax increase but what is more fascinating is that this is the fourth year in a row without a tax increase!

Looking at TESD tax increase chart above for the last four years, you have to wonder how it is that DASD delivered zero tax increases to its residents during the same time period. According to the Daily Local article, the DASD chief financial officer Rich Fazio “attributes the four-year streak of not raising taxes to the foresight of prior school boards.” Fazio states that, “We were fortunate to prudently allocate funds and accumulate savings. Because of that we have not had a tax increase for four years.” He further indicated that DASD “will strive to duplicate a zero increase in taxes for as long as possible.”

The total operating budget for Downingtown Areas School District is $210 million versus TE School District operating budget of approximately $129 million. DASD has a fund balance of approx. $24.5 million versus approx. $32 million in TESD indicating that both districts understand the importance of saving for the future.

Someone is going to have to help me understand how these two Chester County school districts can operate so differently financially – and yes, I understand that TESD is ranked academically higher than DASD.

TE School District has always been an academic powerhouse, so other than 20 miles of separation between the two Chester County school districts, how is it possible that DASD repeatedly holds the zero tax increase to its residents and TESD has had 12 consecutive years of tax increases? Perhaps TESD business manager Art McDonnell could have coffee with DASD chief finaicial officer Rich Fazio to compare notes and discuss financial strategies!

DASD proudly displays the following 2015-16 tax increase chart on their website:

According to the agenda budget materials for tonight’s TE School Board meeting, there were spending cuts before, during and after budget approval to reduce expenditures in the 2016-17 budget. An explanation of those specific reductions would be helpful to taxpayers.

Back in January, school board members Ed Sweeney and Scott Dorsey spoke out against the preliminary tax increase of 4.3% as unacceptable … will they now be OK with 3.6% tax increase? Instead of a typical roll call vote on the TESD 2016-17 final budget, I encourage board members to be accountable and offer the public an explanation of their vote.

Many of the newly school board members used fiscal responsibility and accountability as a campaign platform – now is the time to deliver on those promises.

Many thanks, Pattye, for putting TESD’s endless flood of tax increases into historical and regional context. With some of its fresh blood, the School Board has shown some interest in stemming that tide, but has been unable to offer more than token gestures.

Insights into this lie elsewhere in the Agenda for tonight’s School Board meeting, where the Board looks set to rubber stamp a number of proposals that will translate to perpetual commitments for the taxpayer.

First up, the VFMS fence, independent of the Tredyffrin ZHB ruling on the 6′ height variance along Valley Forge Road. They want to waste $70,000 more that likely will not increase safety (and also to replace a perfectly good fence across the fields).

Next, $4,000 a year increases for Administration and Supervisors – increases in the 3-5% range (before the additional cost of PSERS contributions). This despite the requirement, much touted to the public, of a 1.7% contractual increase. And provided in the Agenda materials with absolutely no context beyond the list of proposed salaries and 1% of that number, which our advanced kindergartners could probably calculate. This for Administrators earning a median $150,000 a year (effectively for life considering the pension – a value of $3 million per person).

And last but certainly not least, a proposed new agreement for Supervisors and Confidential employees that continues the fiction of a 1.7% annual increase, pays 95% of healthcare premiums, 100% of dental and vision premiums and 10 years of Medicare supplement insurance. (And yet we hear complaints about the “uncontrollable” post-employment benefits, which accountants require us to recognize on the balance sheet and for which we choose to reserve fund balance, at the same time paying with our current year taxes.) So we all know exactly the starting position for the upcoming union contracts.

It’s a disgrace. Residents should take notice and vote for change.

Re Valley Forge Middle School fencing project — it is noted that the Zoning Hearing Board has not yet rendered a decision in Appeal #10-16 by TESD in April to build a 6 ft. fence. It is no longer a question “IF” a VFMS fence but rather “HOW HIGH”.

This chart is sobering. I had no idea our tax increases were so much higher than neighboring districts.

Truthfully, if the extra money went to our students, I wouldn’t have a problem paying for increases, but finding out where the money goes makes standing by harder. Fences? Increases in salaries?

Back in January, school board members Ed Sweeney and Scott Dorsey spoke out against the preliminary tax increase of 4.3% as unacceptable … will they now be OK with 3.6% tax increase?

Dorsey wont have any problem with it. Zero credibility.

Downingtown is an interesting district and not one that TE or any district wants to emulate. The allure of zero tax increases for 4 years in a row was only facilitated by extreme over-taxation in the past. It looks like DASD only has a GENERAL fund balance of $24M – a reasonable amount. But what you don’t see is a $100M+ balance in the CAPITAL PROJECTS fund. If you want to make your GENERAL fund balance look small you transfer money into the CAPITAL PROJECTS fund.

.

What we have to realize is that the budget document you see advertised, published and passed each June is subject to manipulation. It’s only an estimate; there are no checks on its accuracy; and a determined board or business manager can manipulate the budget to tell whatever story they want the public to hear.

.

For instance, here are the budgeted amounts and the actual results from the 2014-15 audit (the latest available). You’ll see a startling difference.

The budget said revenues would be $199M; the actual was 3% higher at $206M

The budget said expenditures would be $203M; the actual was 8% lower at $187M

The budget said there would be a deficit of $4M; the district collected a surplus of $18M. That’s $18M more than they needed to operate the district and money that got hidden in the CAPITAL PROJECTS fund which doesn’t have to be mentioned in any budget document. And this is not a one time surplus – the district has collected a significant surplus every year since 2009-10. Thus, the DASD residents should be demanding a realistic budget with the possibility of a significant tax decrease.

.

The good news is that TE is better at doing their budgets than DASD, but not as good as Unionville.

All school districts are incented by the system to over-budget and over-tax. TE has responded to pressure to do a better job, but still has a way to go.

That is not the issue here today, at least for me. My concern is with the spending choices being made – either by commission or omission – and the underlying philosophy, which seems 180 degrees removed from Downingtown’s intent to “prudently allocate funds”.

It would be unwarranted to criticize the current board for a large 3%+ tax increase. That increase was set in stone by the past board when the teachers contract was signed. Teacher compensation of about 50% of the budget. The only way to lower the tax increase is to cut teachers and that will probably affect the education delivered to the kids.

.

What is troubling are the increases given to the administrators. (about 5% of the budget) I’m sure the administrators pointed to the big increases given to the teachers. The teachers will point to the increases given the administrators during the next contract negotiations. And the cycle will repeat until a motivated board stops it.

“”””On the other side of the spectrum, residents of the Unionville-Chadds Ford School District will see the sharpest increase in tax dollars owed to the school district. In 2015-16, a home assessed at $250,070 paid around $7,125. For 2016-17, a home assessed at the same value must pay $7,351 – an increase of $226.”””””

http://www.dailylocal.com/general-news/20160611/all-but-one-school-district-in-county-expected-to-raise-taxes-this-year

“”””””What is troubling are the increases given to the administrators. (about 5% of the budget) I’m sure the administrators pointed to the big increases given to the teachers.”””””””””

Keith, isn’t this an about face for you?

We’re the least tax burdened school district in the area. Look it up. It’s a fact. I’m for investing in my children, programs and teachers that have been continually cut over the years. I worked hard to move into the school district and I’ll be more than happy to pay my increased taxes. I don’t want to be like Downington. I don’t want to live in Downington and I certainly don’t want my kids to go to school there.

We would probably all agree that tax increases for students and programming (especially if for previously cut programs like foreign language in the elementary schools or Latin in the middle schools) is supported — but tax increases which finance overpriced maintenance buildings, 6-ft fencing projects which residents oppose, etc. is an entirely different issue.

Update: Tonight the TE School Board unanimously (9-0) passed the 2016-17 budget with a 3.6% tax increase.

Too bad–another dreary year of paying some of the lowest taxes in the Philly commuting area for the best schools. Sad!

As Pattye notes, the tax increase was approved, as were the above-Index compensation increases, the context-setting employment agreement and a summer program to train Devon PE teachers to teach cricket. We were told – assertions, but no data – that without the $4,000 a year increases Administration and Supervisors would leave, that they are irreplaceable, and that if we did not continue to pay these increases every year – that are nowhere documented in any contract but for which there is a hitherto secret pot of money – then the District would be sued.

Good news, though: the fence at Valley Forge Middle School that is being replaced as part of the project costing $80,000 plus permits, architect fees (11% increase approved last night), consultant fees, Township permit fees, lawyer fees, etc.. will be stored for future use. A good use for the District’s new $5 million building, I guess. And am I the only one that thinks a 4 foot “estate” fence along Valley Forge Road will look ridiculous?

We also learned that Mrs. Lastner was elected to the PSERS Board. Perhaps her insights on interest rates will be helpful there. When the District borrowed $24 million it did not need last year, we were told that rates were “generationally low”; yesterday’s headline in the Wall Street Journal was “How Low Can Yields Go?”.

Those advocating for higher taxes and quoting the relatively low millage rate should understand that the corollary is that the price of housing is relatively high – and it’s the total size of the monthly payment that counts!

At least we need not worry about what next year’s tax rate will be: it’s already previewed to be the maximum allowed by Act 1 – a projected 2.64%. Where we would be without that Act 1 cap, I leave to everyone’s imagination.

We were told – assertions, but no data – that without the $4,000 a year increases Administration and Supervisors would leave, that they are irreplaceable, and that if we did not continue to pay these increases every year – that are nowhere documented in any contract but for which there is a hitherto secret pot of money – then the District would be sued.

What? So we have Administrators working for us who hold us hostage with threats of law suits if we don’t continue to pay them double and triple what those in the private sector get, who pay these top of the pay scale salaries and their raises and bonuses every year?

Why do we have a Board then? Let’s dissolve the Board and call this what it is. We have no say, we never will, because we fold under threats of lawsuits if we don’t lay down and give them everything they want. Outrageous if what you’re saying is true Ray.

They are irreplaceable?

What?

Ray,

I’m reading above where you say:

We were told – assertions, but no data – that without the $4,000 a year increases Administration and Supervisors would leave, that they are irreplaceable, and that if we did not continue to pay these increases every year – that are nowhere documented in any contract but for which there is a hitherto secret pot of money – then the District would be sued.

To be clear, who announced this? Was it Head of the Finance Committee, Virginia? or was it President of the School Board Doug Carlson?

Was Supt. Rich Gusick in attendance? If so, was it awkward for the Board to announce to citizens that the District would be sued by the Administrators, who are supposed to work for the Board, if we did not capitulate to their demands?

Is this supposed to be normal?

Could you please describe this in detail. Thanks.

SL: You’ll need to watch the videotape for the actual transcript. I think it was Virginia that first mentioned the lawsuit risk, but it could have been Dr. Gusick. What is for sure, though, is that the District Solicitor then weighed in with a detailed exposition of the legal theory behind the matter.

The problem arises because we are in a community, like Lake Woebegon, where everyone is above average. That means that everyone gets an above average performance review and has come to expect an above average compensation increase. So that means that the District is apparently legally bound to allocate funds beyond the publicized contractual 1.7% amount for these above-Index increases. This allocation is never revealed in the Budget process and only comes to light when someone – not on the Board – asks a very specific question.

As to normal: it’s interesting that GE was recently in the news for considering doing away with routine annual raises:

http://www.bloomberg.com/gadfly/articles/2016-06-09/ge-s-hr-overhaul-is-more-than-just-words

“Scheduling annual raise conversations can create the expectation (and routine award) of a regular bump. Over a quarter of 120 companies surveyed by Willis Towers Watson said they give performance-based bonuses to employees who fail to meet expectations.”

We do have a lower absolute school tax burden than our neighbors and that have been a fact for as long as I can remember. But, this is not the result of the work of our elected officials. Blessed with a vibrant commercial tax base that trades on occasion (look at the surge we’ve had in transfer taxes); T/E (particularly Tredyffrin) has an enviable commercial property base to drive tax revenues. This is just a fact and the main reason Tredyffrin Township has been able to operate with no tax increases in 3 of the last 5 years (Ray, check me here..). The reason that many companies come to make Tredyffrin their home is the relatively low tax burden. Still the trends can be alarming as the T/ESD tax rate is increasing at the fastest pace in Chester County. Continuation of this policy will ultimately reach a tipping point where our tax burden is NOT an incentive to located a business in our community. We’re not there yet but the balance should be considered.

Where do these increases in our contributions go? This is important. In the last 5 years…most tax increases have ended up as Surplus in the operations of the schools and now those dollars sit in Fund Balance. There was some talk last night about that Fund Balance…and how it has gone down as a percentage of operating expenses. Really….in each of the last 5 years the District has produced a Surplus and grown the Fund Balance….the reason it’s now a lower percentage of Budgeted expenses is because BUDGETED EXPENSES HAVE GROWN FASTER THAN CAPITAL ACCUMULATION. And, it’s important to remember that T/ESD transferred $10.387 MM of Fund Balance to a Capital Fund 4 years ago (see comments above)….it still remains there. Mrs. Lastner promised to “drill down” on Fund Balance adequacy next year…we’ll see.

The citizens of this community have always been willing to support out educational franchise and take pride in it’s accomplishments. BUT, we’ve all been over-charged for the District operations in each of the last five years….that’s a fact. We should all be interested in the plans for the capital accumulated by the District and hope that it is deployed properly and efficiently to support the educational programs we offer. I remain hopeful and vigilant.

In the past 5 years we have been over charged and the surplus has grown, and expenses have grown faster than capital accumulation.

Let’s take stock: What is driving expenses? salaries, raises and bonuses and mostly ballooning PSER’s obligations.

What is driving capital expenses? Since 2008: $7M Admin. offices complete with rehab., $3M rehab for NOC(manager told me it was $1M) (across from TE Middle on Howellville road, go have a look, it’s beautiful, especially top dollar doors and windows) to house tech equiptment, $6M maintenance Building and a close to 30% increase in pay for the manager. Fences that no one wants.

while:

language program cut

no 1 hour start time delay consideration (Too expensive, really?)

parent activity fee

parent computer fee

parking fees

sports fees

the list goes on.

Let’s stop acting as if to make it appear that citizens have a say. We don’t, not until new Board Members are voted in who are motivated to stand up for those they were elected to serve, the citizens of this community.

Imagine an employee going to their boss and threatening to sue the company if they don’t receive a yearly raise, no matter about job performance. What do you think would happen to the employee? Do you think the boss would announce that they are “irreplaceable” and that they will be granted the demanded raise each year? Absurd!

Ray, you said that Virginia was elected to the PSER’s Board. What is the PSER’s Board? Could you expand please.

Here’s the Philly.com announcement of Virginia Lastner’s election to PSERS board.

http://www.philly.com/philly/blogs/inq-phillydeals/Backed-by-4-PSERS-new-board-member-elected.html

you forget shining the outsourceing of aides and paras….. Waters world…

But was this an election, or a sampling survey? Lastner received just 189 votes out of 4,500 eligible elected school directors at the state’s 500 school districts, according to the Pennsylvania Association of School Boards. Only 1,022 eligible votes were received by PSERS. So more than 80% of directors didn’t vote; less than 20% of those who did vote, chose Lastner.

Also Friday, PSERS cut its long-term annual investment target to 7.25%, from 7.5% last year. It was 8.5% back in the mid-2000s.

In a statement, PSERS bragged its returns are up 8.88% “since the Great Recession in 2009,” which is like saying you’ve had a clean driving record since the last time you rolled your car off a bridge into the river.

The Pennsylvania and New Jersey state worker pension funds still project 7.5% yearly long-term returns. All three systems have fallen short of long-term targets in the past 1-, 3-, 5- and 10-year periods, as I reported here.

Lower investment projections mean the system will have to squeeze more money out of state and school taxpayers, either directly (“employer contributions”) or from teachers (“employee contributions”), unless they can get current teachers to agree to collect lower pensions.

And on top of the above, we’re threatened with lawsuits if Admin. pay isn’t increased every year?

I don’t understand this. It makes no sense.

Correct, I forgot about outsourcing of Aides and Paras, low cost HIGH Impact Employees who actually had one on one contact with kids and the $3M dollar pay cut TENIG endures, while Art McDonnell enjoys his higher than the highest paid Governor in the country salary, with his yearly increases and bonuses while tax payers are under threat of lawsuit if he doesn’t get it.

Does anyone know how that works? Does Rich get all the Admin. together and say, let’s take a vote, who votes yes to threaten to sue if we don’t get our automatic raise?

The Solicitor is the one present and employed as counsel when Board Member Liz Mercogliano was barred from secret executive Board sessions, disenfranchising Liz’s entire ward from having a vote in the proceedings to outsource aides and paras, so not sure I trust his theory.

If Administrators believe they are “entitled” to these annual raises it should be based upon what they achieve beyond what they are expected to be doing in their day-to-day scope of work. otherwise, their base hourly rate or salary should compensate them for what they do. At most, they should not be entitled to anything more that a COLA as that is what occurs in the private sector and how Administrators are paid. Normally, a public sector employee gets paid less than one in the private sector so it is interesting that T/E is the reverse. Has anyone questioned this? Also, an Administrator’s annual scope of work is pretty much fixed one year to the next. So again, who can justify these increases. If the basis is annual performance reviews it would appear that the Reviewer is giving little thought about the Added Value the district is receiving from each individual administrator. Food for thought.