The teachers union in T/E school district, Tredyffrin Easttown Education Association (TEEA), provided an update on the negotiation process late last night. The basis for the union’s email was to deliver what the community members have been asking for from TEEA and the school board — transparency.

This latest press release from TEEA is comprehensive … and offers us ‘personal and up close’ information from the union’s perspective on the contract negotiation process. (Something that many of us have asked for, but told was not possible during the ongoing contract negotiations). With this latest communication, TEEA is laying the gauntlet down, providing us with documents that range from copies of their initial contract proposal, the District’s response to an explanation of the grievances.

On April 25, I wrote a post titled, ‘Seeking Transparency in TESD Teacher Contract Negotiations’ in which I called for transparency in the negotiations, suggesting that both sides ‘open the door’ and let the sunlight shine in. Because of the secrecy surrounding the negotiations, even the discussion on Community Matters has turned to conjecture; a world of ‘he said, she said’, which is never good. Some will suggest that this latest attempt on the part of TEEA to be more transparent and inform the public is nothing more than a ‘tactic’ to win favorable support from the parents, students and taxpayers. I will respectfully disagree.

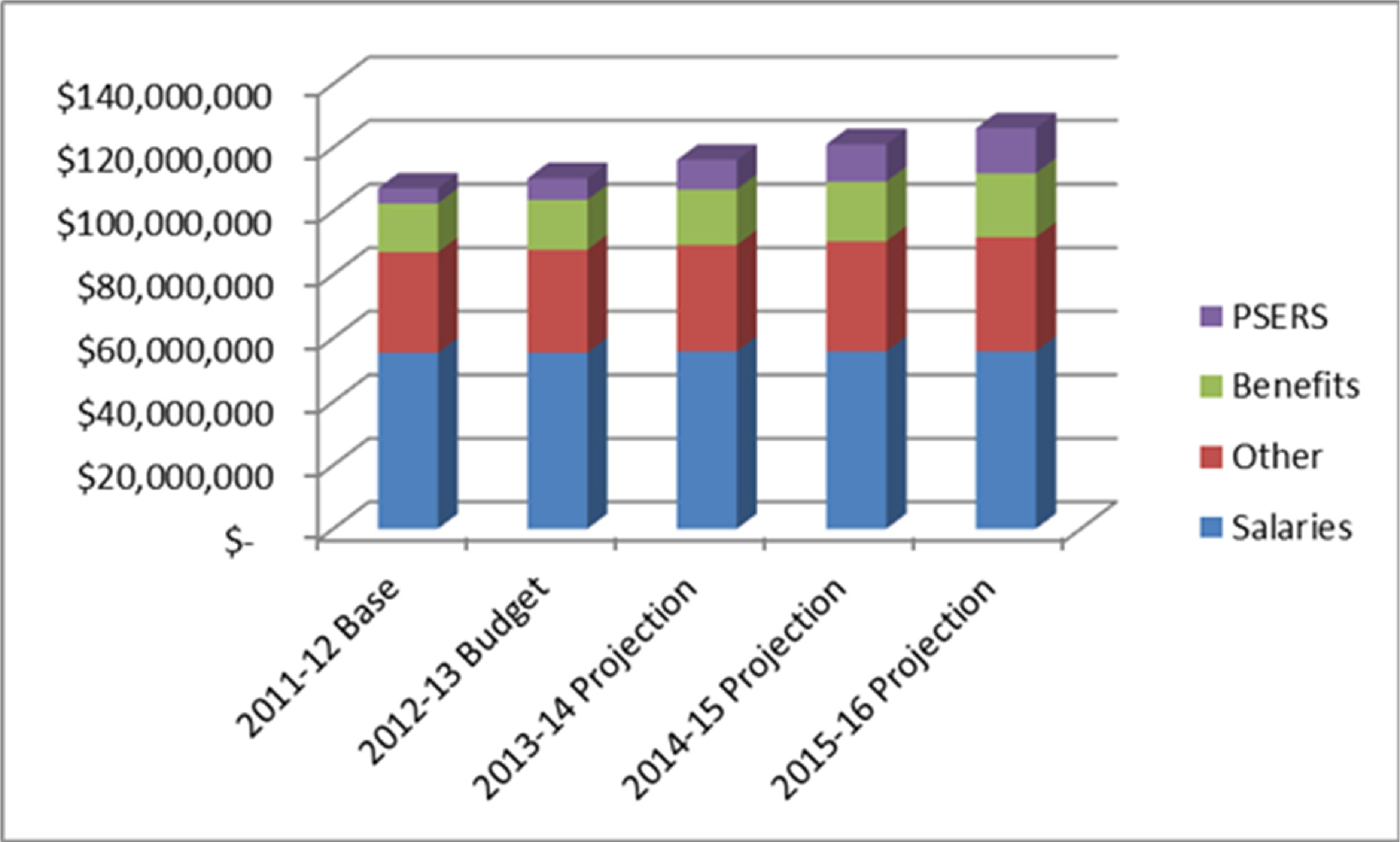

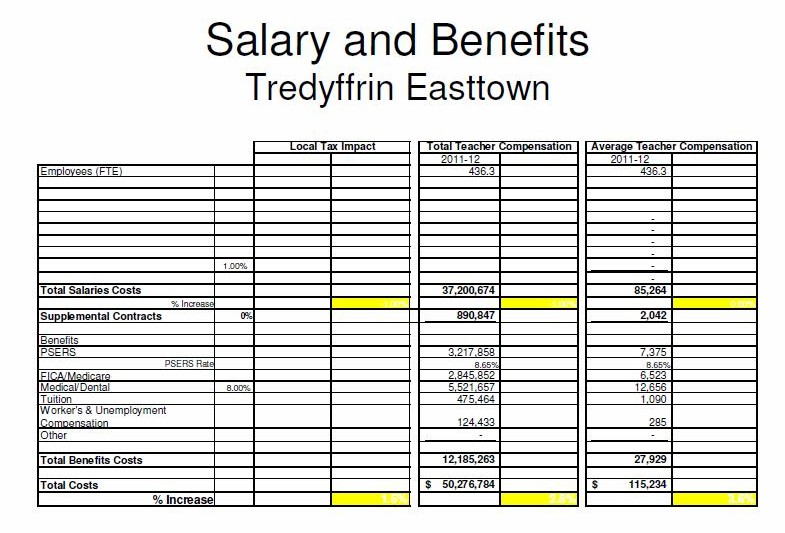

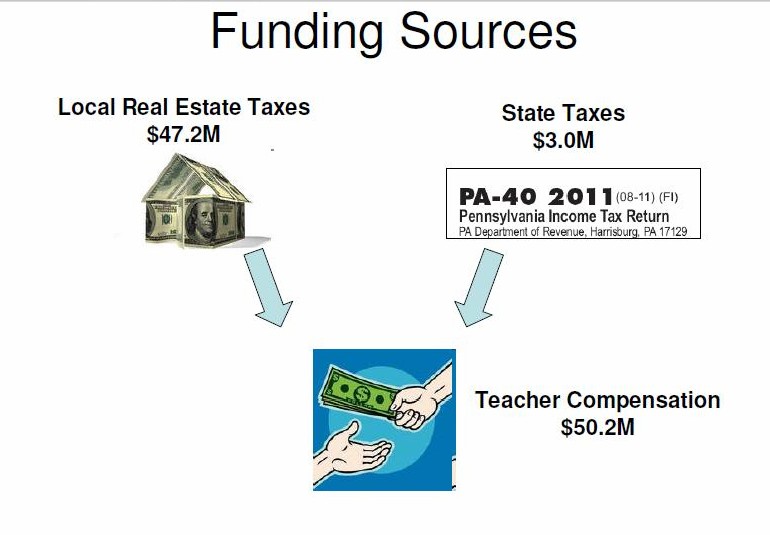

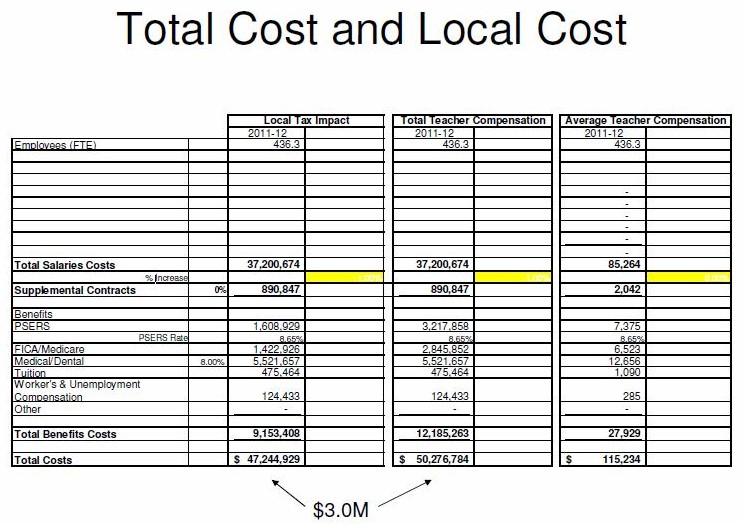

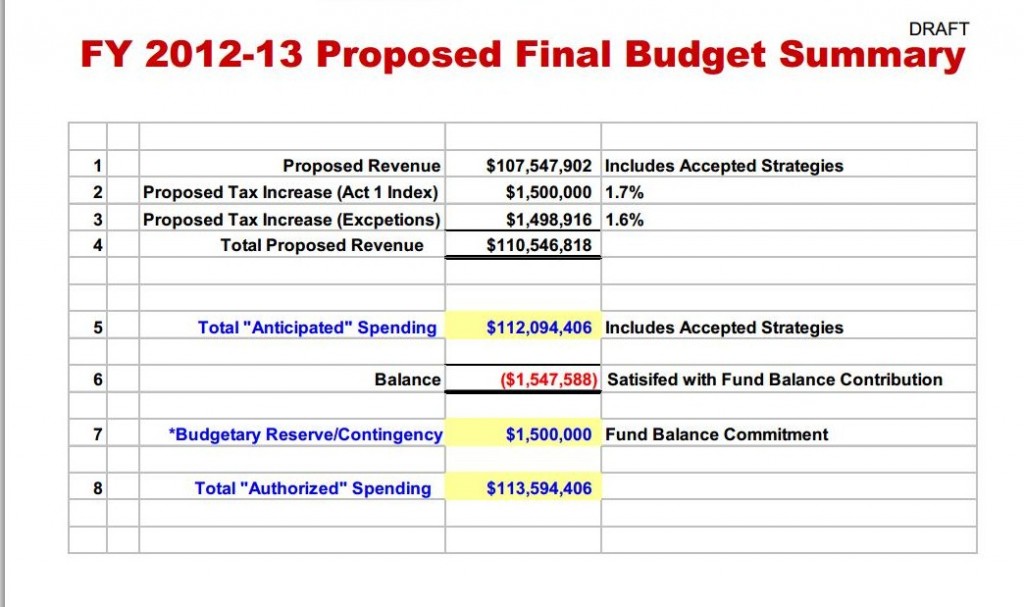

Regardless if you agree or disagree with the contents of the teacher’s proposal, clearly TEEA now sees the merits of the community hearing the facts. To date, misinformation was perpetuated and the line between fact and fiction blurred, with the public left to fill in the gaps between the partial or half-truths from either side. The teachers’ contract accounts for a significant part of the District’s budget and strongly influences the financial ‘bottom line’.

To read TEEA’s latest press release, ‘T/E Teachers, Counselors, and Nurses Offer Opinion on the Negotiation Process’, click here.

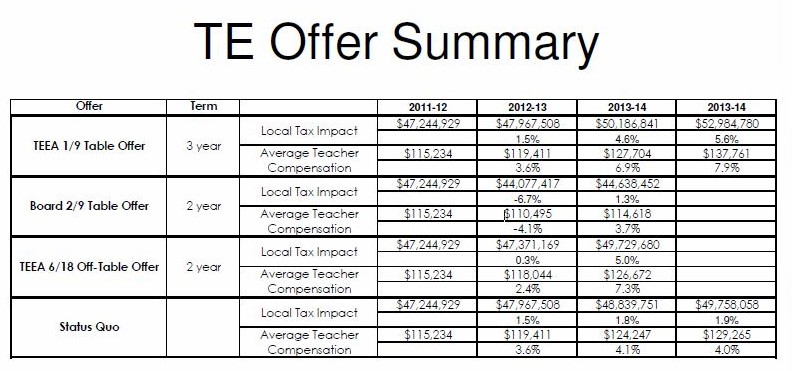

Click here to read the teacher’s union initial proposal dated January 9, which TEEA believed to be a starting point for discussion. Their offer contained a one-year salary freeze for all teachers, second year freeze for those at master level. According to the union, they also ‘made repeated verbal commitments to discuss changes to healthcare benefits’.

The School Board rejected the teacher’s initial proposal on February 9. Click here to read the District’s 113-page counter-offer to TEEA. According to TEEA, this is the only offer to date made by the Board. If you recall, several teachers had commented on Community Matters regarding the District’s offer, claiming that family health coverage was not included in the District’s offer. Many readers questioned whether the elimination of family health coverage was in the counter-proposal; suggesting that unless the public saw it ‘in writing’, the information may not be accurate.

We can now read the District’s counter-proposal and it appears clear to me that option for teachers to insure their spouses and/or children is indeed eliminated, as is dental and vision coverage. I do not see how it can be interpreted differently – there appears this offer has no option for teachers to have family health insurance coverage through their employment in TESD. In addition, to be clear, the District’s counter-proposal includes no option for the teachers ‘to buy’ health insurance for their families.

In their latest press release, TEEA goes on to detail other areas the District counter-proposal seeks to eliminate or reduce, some of which could be viewed as reasonable given the economic climate and the severity of the budget situation – example, reducing the teacher’s stipend rates on mentor programs and homebound instruction. The District in their counter-offer seeks to freeze teacher salaries indefinitely – given the economics, although not satisfactory, the school board probably feels they have little option.

TEEA revised their initial proposal (click here) and presented it to the District on February 29. The District responded that they were unwilling to discuss the health care benefits. According to TEEA, it was shortly afterward that the ‘demotions of professional staff for economic reasons’ became a viable budget strategy option. As a result, the public has watched the circus-like atmosphere that now ensues at school board and finance committee meetings which has included students, parents, teachers and taxpayers. Additionally, the last couple of meetings have included the District releasing information that TEEA has filed two grievances, leaving some of us with questions. The union addresses the grievance issue in a FAQ, click here to read.

As I have repeatedly stated in other posts, making the teacher contract negotiation process transparent for the public would help the community understand how our children will be taught and how our tax dollars will be invested. The relationship between teachers and school administrators is an important element in what shapes this school district. There is no better way to understand this relationship than to observe the contract negotiation process. However, based on the way this process has worked to date, to suggest that the current relationship between the teachers, administrators and school board is ‘strained’ would be quite an understatement!

With the release of this information from the teachers union, I believe that TEEA is attempting to shine light and bring transparency to the contract negotiation process. However, for the transparency process to be successful, requires open dialogue from both sides.

Is it possible that the District and TEEA can put the needs of the students and families first and at the same time, honor the public investment of taxpayers? Can both sides be more open about the negotiation process – talk truths to each other and to the public?

Back on June 19, the contract negotiations between the T/E School District and the teachers union, Tredyffrin Easttown Education Association (TEEA) reached an impasse and both sides requested that the PA Labor Relations Board (PLRB) assign it to a ‘Fact Finder’. The neutral third-party was to review the proposals of TESD and TEEA and then make a recommendation.

Back on June 19, the contract negotiations between the T/E School District and the teachers union, Tredyffrin Easttown Education Association (TEEA) reached an impasse and both sides requested that the PA Labor Relations Board (PLRB) assign it to a ‘Fact Finder’. The neutral third-party was to review the proposals of TESD and TEEA and then make a recommendation.