This post continues to follow the T/E School Board’s proposed 6% tax increase and what some in the community believe is a significant accounting error in the District. I attended the Finance Committee meeting this week which was scheduled for 7 PM with the Budget Workshop to follow at 7:30 PM.

This post continues to follow the T/E School Board’s proposed 6% tax increase and what some in the community believe is a significant accounting error in the District. I attended the Finance Committee meeting this week which was scheduled for 7 PM with the Budget Workshop to follow at 7:30 PM.

First off, let me say that this is not the post I want to write nor had hoped would be necessary! The scheduled half-hour Finance Committee went on for two hours, with the first opportunity for the public to ask questions not coming until 9 PM. The Budget Workshop started at 9:30 PM and went until midnight.

At the end of the 5 hour meeting, the public knew no more than when the meeting started. The tax increase remains at 6% and for many school board members, there is reluctance for “doing what’s right” regarding the accounting error. Instead, there is a preference to “stand by our man” Art McDonnell, the District’s Business Manager.

I don’t claim to be a CPA or have a lengthy financial career but fortunate for us, there are many in this community that do – including residents Neal Colligan, Mike Heaberg and Ray Clarke. Each attended the Finance Committee meeting and Mike and Ray stayed until midnight for the Budget Workshop. In my world, you should always “play to your strengths”; it would have been extremely valuable to the public if the school board really listened to these community members, rather than choosing to negate, dismiss and at times insult them.

It was obvious from the first comment period following the Finance Committee meeting that this was not going to go well, when the chair interrupted my comments to say he didn’t like my “tone”. Mind you, that is after the public had waited TWO HOURS to comment!

I found it incredulous that since the last school board meeting two weeks ago, the Business Manager had not found time to review the impact of the accounting error on this year’s tax increase! But more shocking was that School Board director Heather Ward stated she had asked McDonnell several times for the information and the Board still had not received it. McDonnell’s response as to when he would have the information – by next Finance Committee meeting a month away!! It should be noted that Ray Clarke, Mike Heaberg and Neal Colligan have already done the analysis caused by this accounting error yet the business manager doesn’t have the time.

The public was told at the March 23 School Board meeting to come to the Finance Committee meeting for answers! The only answer that we now know is that the District’s accounting error occurred in Oct/Nov 2016 and that the School Board was not told about the situation until January 2019 – 14 months later. I actually told the school board that I felt sorry for them in this regard – guess the Administration didn’t think that a $1.2 million accounting error was all that important. I also stated that we elected them (the School Board) for District oversight, not Art McDonnell, the business manager.

The continuing to “kick the can” on the accounting error by the school board is not just frustrating but shows a lack of leadership and ability to govern even as some in the public make suggestions of possible legal action.

Although the Finance Committee meeting was not televised and it becomes a “he said, she said”, the public can see the video of the Budget Workshop. You don’t have to watch the entire video but I beg you to PLEASE review the comments which starts at time stamp 1:34:45. Click here for the video.

It is extremely important that you hear the comments of Mike Heaberg, former member and chair of Tredyffrin Township Board of Supervisors and a financial management executive. After waiting over four hours to make his remarks regarding the District’s serious accounting error, perceived impact on the tax increase, possible legal action, etc., Mike’s comments were thoughtful and important. After the public comments, continue to watch and hear the responses from the school board, in particular the Finance Committee chair’s response to Mr. Heaberg. Truly unbelievable and this from the man who told me hours earlier that he didn’t like my tone!

The public needs to wake up (although one School Board member would have you believe that those in the audience don’t represent the community!) Let me repeat, Mike Heaberg, Ray Clarke and Neal Colligan are financial experts and have done the accounting analysis (even though the District business manager has not found time!) All three come out at the same place with regards to the impact of the accounting error on the proposed 6% tax increase. Who on this School Board comes close to their financial backgrounds and depth of understanding? However, for many on the school board, the choice is to dismiss the comments/suggestions of the community financial experts in favor of the business manager – even as the trust in their ability to govern is questioned.

The end result of five hours of Finance Committee/Budget Workshop meetings and where the public expected answers – there were none. The tax increase remains at 6% and with suggestions of legal action afloat regarding the District’s accounting error, many on the school board remain committed to Art McDonnell. Not my brand of governance or leadership!

Because I left following the Finance Committee meeting (I did however watch the Budget Workshop), Ray Clarke provides his remarks and commentary for us – and we thank him!

The combined Finance Committee/Budget Workshop on Monday was a five hour marathon, ending past midnight. Unfortunately the audience, and possibly a few of the Board, came away as perplexed as before.

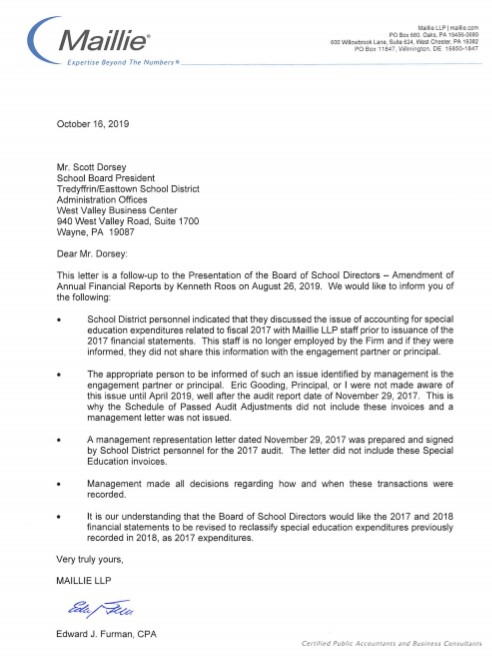

We heard a high level outline of the source and timeline of the error, pinned to a clerical mistake in the Department of Specialized Student Services that resulted in the CCIU invoices being recognized after the 2016-17 audit was complete in November 2017. The auditor signed off on the incorrect financials for 2016-17 which then were submitted to the state. A year later the auditor also signed off on the 2017-18 financials, and the two incorrect state reports then became the basis for the district-authorized Exception request to the state for next year’s Budget. It appears that the Board learned of this sometime in 2019.

The Chair of the Finance Committee relied almost exclusively on the auditor approval to support his conclusion that the issue is not material. Others felt that even though the numbers are incorrect, that’s OK because in their view moving the expense from one year to another just changes when the Exception can be taken. (Partially but not totally true: packing expenses into one year increases the amount that is above the Index; and even if an Exception were allowed last year, the Board might not have taken it – as they claim they so often do not!). There were no numbers presented in support of this, although Ms Ward said that she had requested the information two weeks ago. She obtained a commitment from Mr. McDonnell that the analysis (which in essence has already been seen here on Community Matters) would be presented at the next meeting in four weeks’ time.

In the Workshop, the Board spent a lot of useful time debating the merits of individual programs that could be used to balance the budget in the event of a lower than 6% tax increase, which seems to be the universal desire. There are strongly diverging views on the merits of selective fee increases that increase the cost to families (who choose to move to T/E “for the school district”, remember) versus elimination of headcount additions for, say, security. There are certainly opportunities not yet baked into the Budget – areas like staff retirements and use of up-to-date assessment information (here, as Ms. Ward said of the tax issue: “show your work“). However the Board did not come close to meeting President Dorsey’s goal, and the Admin request, to set parameters for the tax increase and deficit. The best we got was his own preference for a 3.8% tax increase (which would be roughly the rate with the right Exception), and general discussion that implied that a $1 to 1.5 million deficit would be livable. On the latter, it’s important to note that District Policy does not allow Fund Balance to be used for operations, so it will be important to identify programs like the $300,000 cost of setting up a new reading program that are legitimately one-time expenses – IF the expense is taken out of future year’s budgets.

Those of us in the audience were chastised by Mr. Boyer for not actually representing the community. My own sense from the people in my orbit about this is very simple:

– Regardless of the impact, the Board should not endorse incorrect state reporting

– If the district is to be managed effectively going forward, correct numbers must be used to analyze trends and cost drivers

– The District should limit the 2019/20 tax increase to the allowable maximum

– There’s a real trust problem when:

— A Board does not learn of an issue that impacts taxation for over a year

— A Board member has to ask the Business Manager to “show your work”

— That request for information is not complied with