We know that there’s no going back, no “do-overs” – the TE School Board voted for its 2020-21 budget this week which includes a 2.6% tax increase. However, this morning I learned that the Downingtown Area School District School Board passed its 2020-21 $230 million budget with a ZERO TAX INCREASE. Remarkably, this marks the 8th year in a row for no property tax increases for the Downingtown Area School District (DASD) residents. What is the administration and school board of DASD doing differently than TESD?

We know that there’s no going back, no “do-overs” – the TE School Board voted for its 2020-21 budget this week which includes a 2.6% tax increase. However, this morning I learned that the Downingtown Area School District School Board passed its 2020-21 $230 million budget with a ZERO TAX INCREASE. Remarkably, this marks the 8th year in a row for no property tax increases for the Downingtown Area School District (DASD) residents. What is the administration and school board of DASD doing differently than TESD?

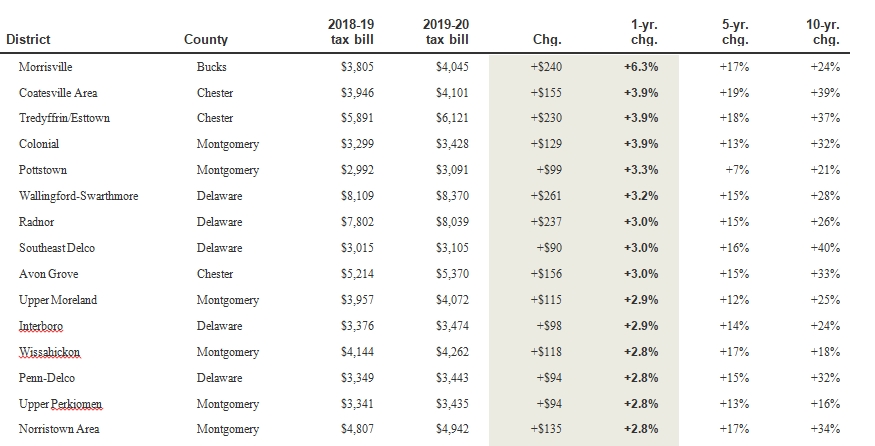

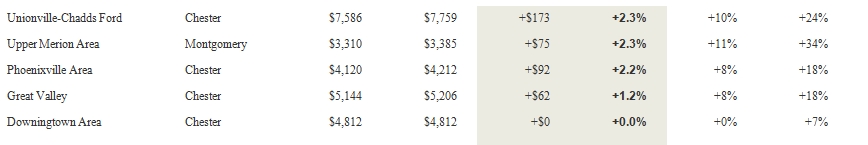

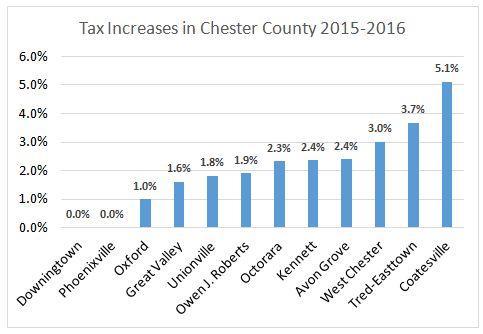

How does DASD manage to control expenses without tax increases? Are the administration and teacher salaries that different? On the other side, the 2.6% tax increase for 2020-21 is the 16th straight year of tax increases in TESD. TESD had the distinction of the highest tax increase in Chester County in 201902 — it will be interesting to see where TESD tax increase lines up for the 2020-21 budget year in the midst of Covid-19.

As of this morning, TESD has not updated its website with the budget results (or video) from the June 8 school board meeting. However, DASA voted last night (June 10) on its 2020-21 budget and has already posted the press release with results its website. It is easier to announce good news!

I was particularly impressed to read that “ … DASD is the only district in Pennsylvania to earn the highest rating of AAA from both Moody’s and S&P rating agencies for the district’s superior financial health, and the district has earned the Meritorious Budget Award from the Association of School Business Officials fifteen years in a row for excellence in budget presentation.” Would the same be said about TESD budget preparation and business manager?

Congratulations to Downingtown Area School District on this achievement – here’s the full press release:

On June 10, 2020 the Downingtown Area School District (DASD) Board of School Directors approved the 2020-2021 school district budget. For the eighth year running, the budget has been approved with no school property tax increases.

The unanimous vote approving the $230.8 million budget shows a 1.99% increase in expenses over last year’s budget. Understanding that the full financial effects of COVID-19 are not yet known, the district was conservative, committing to an operating budget of $226.6M with $4.2M set aside in a contingency fund. The Board of School Directors has the option to approve use of contingency funds based upon need and the strength of the economy.

Superintendent Emilie Lonardi commented, “As a district, we are committed to being fiscally responsible to our taxpayers. Thanks to the careful planning of our Board of School Directors and team of administrators, we are fortunate to be able to avoid a tax increase for the eighth year in a row.”

The Downingtown Area School District is the largest School District in Chester County and seventh largest in Pennsylvania. DASD is the only district in Pennsylvania to earn the highest rating of AAA from both Moody’s and S&P rating agencies for the district’s superior financial health, and the district has earned the Meritorious Budget Award from the Association of School Business Officials fifteen years in a row for excellence in budget presentation.