At tonight’s TE School District meeting (7:30 PM, Conestoga High School), the school board will vote on the 2016-17 final budget and property tax rate.

In January, the board had adopted the preliminary budget which contained a 4.3% tax increase – they approved the budget with the Act 1 Index of 2.4% and allowable Act 1 Exceptions of 1.9%. At the April 25, 2016 regular school board meeting, the proposed final budget reduced the property tax rate from January, from 4.3% down to 3.875%.

According to the meeting agenda and budget materials (click here) the board will vote on the District’s 2016-17 final budget with an Act 1 Index of 2.4% and Referendum Exceptions of 1.2% for a 3.6% tax increase to the taxpayers.

The following chart shows TESD tax increases over the last twelve years. 2004-05 was the last zero tax increase year.

- 2015-16: 3.81%

- 2014-15: 3.4%

- 2013-14: 1.7%

- 2012-13: 3.3%

- 2011-12: 3.77%

- 2010-11: 2.9%

- 2009-10: 2.95%

- 2008-09: 4.37%

- 2007-08: 3.37%

- 2006-07: 3.90%

- 2005-06: 1.40%

- 2004-05: Zero Tax Increase

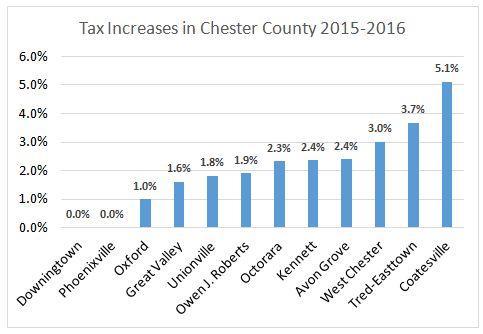

The TE School District residents can take solace that they are not alone in their tax increase. According to Adam Farence’s Daily Local article, 11 out of the 12 school districts in Chester County contain 2016-17 budgets with tax increases.

The only Chester County school district without a 2016-17 tax increase is Downingtown Area School District. DASD recently approved their 2016-17 budget with no tax increase but what is more fascinating is that this is the fourth year in a row without a tax increase!

Looking at TESD tax increase chart above for the last four years, you have to wonder how it is that DASD delivered zero tax increases to its residents during the same time period. According to the Daily Local article, the DASD chief financial officer Rich Fazio “attributes the four-year streak of not raising taxes to the foresight of prior school boards.” Fazio states that, “We were fortunate to prudently allocate funds and accumulate savings. Because of that we have not had a tax increase for four years.” He further indicated that DASD “will strive to duplicate a zero increase in taxes for as long as possible.”

The total operating budget for Downingtown Areas School District is $210 million versus TE School District operating budget of approximately $129 million. DASD has a fund balance of approx. $24.5 million versus approx. $32 million in TESD indicating that both districts understand the importance of saving for the future.

Someone is going to have to help me understand how these two Chester County school districts can operate so differently financially – and yes, I understand that TESD is ranked academically higher than DASD.

TE School District has always been an academic powerhouse, so other than 20 miles of separation between the two Chester County school districts, how is it possible that DASD repeatedly holds the zero tax increase to its residents and TESD has had 12 consecutive years of tax increases? Perhaps TESD business manager Art McDonnell could have coffee with DASD chief finaicial officer Rich Fazio to compare notes and discuss financial strategies!

DASD proudly displays the following 2015-16 tax increase chart on their website:

According to the agenda budget materials for tonight’s TE School Board meeting, there were spending cuts before, during and after budget approval to reduce expenditures in the 2016-17 budget. An explanation of those specific reductions would be helpful to taxpayers.

Back in January, school board members Ed Sweeney and Scott Dorsey spoke out against the preliminary tax increase of 4.3% as unacceptable … will they now be OK with 3.6% tax increase? Instead of a typical roll call vote on the TESD 2016-17 final budget, I encourage board members to be accountable and offer the public an explanation of their vote.

Many of the newly school board members used fiscal responsibility and accountability as a campaign platform – now is the time to deliver on those promises.