Last week I was contacted by Laura McCrystal, a writer with the Philadelphia Inquirer asking about TESD’s recently approved tax increase of 3.9%. Although she was very aware of our District’s ongoing saga over the $1.2 million accounting error, Laura was clear that the article she was working on was specific to greater Philadelphia area school districts and a comparative analysis of school taxes.

Last week I was contacted by Laura McCrystal, a writer with the Philadelphia Inquirer asking about TESD’s recently approved tax increase of 3.9%. Although she was very aware of our District’s ongoing saga over the $1.2 million accounting error, Laura was clear that the article she was working on was specific to greater Philadelphia area school districts and a comparative analysis of school taxes.

For the record, the $1.2 million accounting error caused by the District’s delayed payment of a special ed invoices remains an open issue. Although the school board acknowledged and voted to correct the error with the PA Department of Education, as of the last school board meeting it had not yet been done.

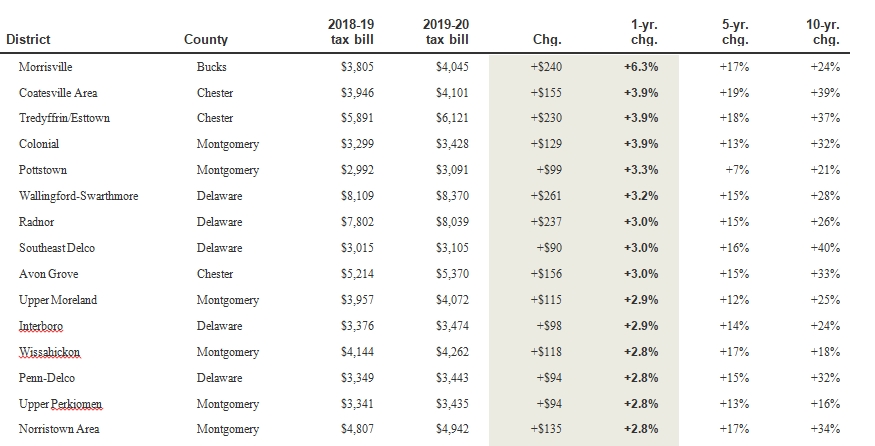

The Philadelphia Inquirer published its article, “How much are your school taxes increasing? Here’s a district-by-district look at the Philly region” which is a fascinating read — and analysis of tax increases in the region. Although the T/E School District generally like to come in at first place, on the tax increase list we tied for second highest increase! Yes, our District received the distinction of the second highest tax increase (3.9%) in the greater Philadelphia region – second only to Morrisville School District in Bucks County with a 6.7% tax increase. (If you recall, the T/E School Board had originally passed the proposed final budget (5-4 vote) in late April with a 6% tax increase which was later reduced to 3.9% in June.). Below shows the highest tax increase school districts:

In discussion with the Philadelphia writer, I was asked about the impact of rising taxes on the community. As was stated in the article, I worry “ about a lack of scrutiny on the school budget and its rising taxes because so many residents move to the district so that they can send their children to its high-performing schools. “There are some who are inclined not to be concerned about the taxes that are being paid because they feel like the value they get offsets that,” she said. “But I think part of the problem is that as a result of people moving here for the school district … the budget process is not scrutinized as much as it would be.”

I expressed concern that our school district tax increase is not an isolated one year increase – but that we should look at our tax increases year after year. As was stated in the article, I have been tracking the tax increases in T/E School District for the last 15 years and you need to go all the way back to the 2004-05 year for the last zero tax increase! Looking at the chart above, you see that our District has had an 18% tax increase over the last 5 years and a whopping 37% during the last 10 years.

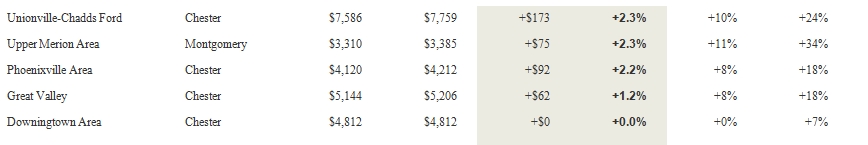

I excerpted neighboring school districts Unionville-Chadds Ford, Upper Merion, Phoenixville, Great Valley and Downingtown from the Philadelphia Inquirer chart.

Looking at nearby Great Valley School District, they are keeping taxes significantly lower than T/E with a 1.2% tax increase for 2019-20 school year, 8% increase for 5 years and 18% increase for 10 years. Great Valley is another high achieving school district with similar performing students, special ed needs, rising pension costs, etc. so what accounts for the dramatic tax difference between GVSD and T/E?

But look at Downingtown Area School District! According to Niche, Downingtown Area School District has 12,656 students in grades K-12 with a student-teacher ratio of 15 – 1 and according to state test scores, 69% of students are at least proficient in math and 85% in reading.

Some will argue that Downingtown Area School District is not in the highest performing echelon of area school districts (like T/E, Unionville-Chadds Ford, Lower Merion or Great Valley) but they operate ten elementary schools, three middle schools and three high schools and somehow manage to have a ZERO tax increase for 2019-20, ZERO tax increase for the last 5 years and only 7% tax increase for the last 10 years.

Downingtown is operating a large school district that has rising pension costs and increased special ed expenses like all the other school districts, yet successfully delivers zero tax increases to their residents year after year.

I’m not suggesting that we all move to Downingtown School District but there should be some kind of balance — why is it that as residents of the T/E School District we are faced with significant tax increases year after year?

Families move to the T/E community for the school district and are generally satisfied as long as the high test scores are maintained. As a result, there is a certain complacency when it comes to the District’s budget and our ever-increasing taxes. Guess the question becomes, how long are these yearly tax increases sustainable by the District’s taxpayers?

To answer your question, NO the rate of tax increase is NOT sustainable! How is it that other area school districts manage costs and spending so much better than TE? I for one, would like TE to replace the business manager, how about the one that Downingtown has? I bet he/she is making a fraction of what ours gets paid.

Our taxes are high because the average teacher salary in TE is $92,600. Not including gold standard healthcare and pension benefits.

They’ll talk you to death about how it’s special ed, charter schools etc. It isn’t. All your tax increases go to ever rising pension costs and $2M in budget increases (forever) at every next contract negotiation. There’s another one in 2020. They never mention salaries and healthcare when explaining tax increases. The teachers will groom and take over a select group of kids by being very nice to them, giving them opportunity, making them feel special so the kids will advocate for teacher raises. They take over parents too but students should not be subject to this manipulation. They should not be permitted to wear t-shirts in school in a shameful attempt to garner sympathy from unsuspecting students.

Why don’t you work as hard for your students as you do for yourselves?

School Board, do not be afraid. They count on your fear.

Yup, the kids just magically get great test scores and grades by accident. Has nothing to do with teachers

It isn’t magical. It’s due to good parents with high expectations who care about their children and support them in what they do. It’s due to their children who have a strong desire to work hard and achieve their goals. 20 to 30% of students at the High School could teach their classes. Another 20 to 30% would get A’s in the class taught by the students. Really, teachers in TE only have to really teach and help every now and then, 20 to 30% of their students. They don’t do that. If the child doesn’t get it, needs help, or encouragement, forget it. That is the truth.

You’re completely delusional

So, you’re saying that upwards of 60% of T/E high school students don’t need teachers since they can either teach the course themselves or learn it (to the point of getting an “A” grade) from another student teaching it. And, the remaining students just need to be taught every once in a while but the teachers don’t even do that. That all seems unlikely.

Not everyone who lives here has children in the school district. As seniors without children who live on a fixed income, the taxes are killing my husband and I.

Less than 20% of residents have children in the school district.

This is a game. It’s all about the money. Public school is supposed to be the great equalizer. It’s anything but. You have to pay to play. Not only do they raise our taxes year after year to fund their already bloated salaries, parents pay thousands and thousands of dollars so their kids can participate, while they cry poor and report how tight the budget is so parents feel obligated to pay even more.

Most coaches are teachers. They hold year round clinics costing hundreds if not thousands of dollars. They tell you it’s not mandatory to participate in the clinics to participate in the sport. Yeah right…..that is not true. Kids who don’t participate in the clinics have no chance. They are ignored, marginalized and made to believe they aren’t good enough. If you don’t pay, if you don’t support the clinics, if you don’t serve them and treat them like royalty, your kid doesn’t have a chance and that’s the truth and a lot of people know it but won’t say it.

True that.

Time to resurrect the tax spiral model: rising taxes squeeze out those on fixed incomes, who are replaced by young families that directly benefit from the schools, who increase student enrollment, which raises costs, which raises taxes, which squeezes out those on fixed incomes, who are replaced …..

All well and good maybe while house prices are buoyed by low interest rates that keep the combined monthly mortgage and tax payment under control. At some point, though, the value equation will reach its limit – for both residents and the commercial base that pays a quarter of our school costs.

We depend on the School Board to take to heart the numbers that Pattye presents above, and to recognize that there are some important laws in effect here: that of compound numbers (a 37% tax increase in 10 years!), and of course Parkinson’s Law: the Administration will have no trouble spending all the money the Board extracts for them.

A few comments –

I caution everyone to look closer when comparing school district tax increases. Each district has unique factors, beyond the control of the school board, that lead to high or low tax increases.

Downingtown has an earned income tax (EIT) which has brought in a bonanza over the last few years as the economy has soared. The township has encouraged commercial growth which adds no new students, adds to the real estate tax base and brings in new workers whose income is subject to the EIT. Most if not all the districts mentioned in comparison (UCF, GV, TE, LM) do not have an EIT.

Some districts are challenged by large enrollment growth. Larger tax increases may be warranted.

Some districts are challenged by large increases in special ed expenses. Larger tax increases may be warranted.

Take heart. Taxpayers are protected by Act 1 that prevents rouge school boards from enacting outlandish tax increases.

Note: It’s unreasonable to expect zero RE tax increases. Unlike income taxes and sales taxes that automatically adjust for inflation, a real estate tax does not adjust for inflation. That’s why Act 1 expects a district to increase RE taxes in the 2% to 3% range each year to compensate for inflation.

I appreciate your comments Keith but it should be pointed that in the last 15 years, T/E has exceeded that expected Act 1 increase in the 2-3% range 10 times.

Even my favorite district, UCF, raised taxes above the Index 9 times over the past 15 years. I think you’ll find most districts did the same because of the large mandated increases in pension contributions. (over the past 15 years the contribution went from around 1% of salaries to 34% of salaries) Thankfully, PSERS contributions have stabilized and the PSERS exception to the Index cannot be used in future years.

There is no simple solution for those on fixed incomes being hard-hit by school tax increases. The PA constitution does not allow special status for seniors on fixed incomes. Any type of a LOCAL income tax (EIT or PIT) would help, but the electorate would have to approve it via a referendum. Very unlikely! The legislature could step in and abolish RE taxes via HB76, but we’ve seen how difficult it is to get legislative support and HB76 has a host of problems.

All that said, TE residents must rely on a well-informed, wise school board to provide an excellent education at an affordable cost. The recent budget debacle provides evidence that the TE board is lacking.

Keith,

You say,

“”””””The legislature could step in and abolish RE taxes via HB76, but we’ve seen how difficult it is to get legislative support and HB76 has a host of problems.””””

It is my understanding that HB 76 lost by 1 vote last time it was up for a vote. Am I correct that there is strong support for it among legislators and their constituents? What do you see as the host of problems with HB 76 that would put us in a worse predicament than we’re in now? Thanks

Some good points, Keith, but we should not forget, as the school district conveniently does, that the tax base does grow – even in “built out” TE. And when was inflation last at 2-3%?

You show how important it is for our representatives at both the township and school district to think outside the proverbial box. How about an EIT? How about stopping pandering to developers who fill up sites with residential units and then ask for ordinance variances because there is “no room” for required stormwater systems, landscaping, etc.? How about planning to encourage residential diversity and quality of life, plus smart commercial development?

Tredyffrin is about to embark on a process to update its Comprehensive Plan. Residents should get involved!

Ray,

Most of us think the best measure of inflation is he CPI and by that measure school district tax increases are excessive. But school district don’t purchase consumer goods; they purchase educational services. The Act 1 Index is an excellent benchmark for the inflation associated with educational services.

I agree that tax base does grow (4.4% in the last 5 years), but with the growth of the tax base comes more students to educate (9.8% in the last 5 years). Your comment about the Comprehensive Plan is apropos.

Good point about the Comprehensive Plan. I asked the BOS last year about the “housing units” number that was in the plan.

The response I got was they didn’t know how it was calculated and to contact the School district demographer at Sundance Assoc.

I honestly don’t think they care about over development. Look at the potential developments on the Fritz property and Handels property. Who is responsible to look at the BIG picture for the school district? Or do we just listen to the developer that says out of 125+ units there will only be 3-6 students added to the school.

There needs to be some coordination of efforts between the townships and school district.

Keith,

I agree with Pattye. I don’t think many citizens would disagree to a 1 to 2% tax increase. I also think that it’s true that the true cost driver is salaries, benefits and pensions. The School Boards answer to this over the last 12 13 years is to cut student services and programs, increasing out of pocket costs for parents, while at the same time increasing salaries, benefits and pension obligations to tax payers to the tune of $2M at each contract time. The only segment to benefit is the employees. Half of teachers in TE make more than $93,000, many make more than $100,000. They get summers off, Christmas vacation of 2 to 3 weeks, Spring Break and the list goes on. Teachers take many sick and personal days during the year too. One year, my middle schoolers Math teacher was absent 2 to 3 Days a week for 6 weeks. I finally called the school and the Administrator had no idea what I was talking about until she checked it out. It’s absurd.

Keep a sharp eye out for any expansion of residential housing. At $18,000-20,000 per year per student the costs for 13 years is explosive. Also, pension reform at the State level is critical.Keep in mind that teachers who are earning on average $92,000 are getting $75% of that after 30 years. And they don’t need to be concerned about the financial markets. It is no wonder when you take a cruise you encounter so many retired teachers.

Agree Susan.

Check out $100,000+ retirement villas too. You’ll find many retired teachers, judges, government workers.

Thanks to Pattye, Keith and Ray for comments/input on a serious matter. One to which all T/E residents should pay close attention.

However, we are ALL T/E Taxpayers. And the idea that our school teachers are of only passing importance to the success of our students is, frankly, ludicrous.

Mike,

Going by personal experience. Do you have personal experience?

Taxpayer,

You asked, ” What do you see as the host of problems with HB 76…….?”. Here are a few “off the cuff”.

1) It puts collection and distribution of school revenue in the hands of the state legislature. These are the same people who created the PSERS pension mess and the ones who cannot pass a budget on time. While I’m not happy with the performance of the TE board, they are better than the state legislators and you have a better chance of influencing them and voting them out. Can you imagine Ray or Mike or Neal going to Harrisburg to make a point?

2) It takes control of schools out of the hands of locally elected school directors. If you can’t control the money you have no control.

3) TE money will be used to subsidize Lower Merion. As the bill is written now each district gets the same funding that is currently in place. LM will be able to continue spending $30K per student; while TE is limited to $20K.

I actually like a shift from RE taxes to a PIT or EIT (personal income tax or earned income tax), but I’d like the money raised in each district to stay in the district. You may or may not remember that Act 1 of 2006 required a referendum in each district as to whether to offset up to 50% of RE taxes with an EIT or PIT. It failed in almost every one of the 500 districts.

Neither HB76 or SB76 have gotten out of committee. There have been no committee votes or any floor votes.

I agree that the state legislature are the same people who created the PSERS mess and can’t pass a budget. The TE Board is not better than the state legislature. The problems with this TE Board are the same problems that have been with every TE Board. 9 people with very busy lives—-work, kids and outside obligations who go in with good intentions but find the job is nothing like they imagined and that standing up to Art and the Administration is a monumental task that they just can’t seem to do so they not so slowly but surely give in and rubber stamp everything they want. It’s not going to change no matter what citizens are elected. Not their fault. By design, most Administrators have been around for years….20+. They’re are very experienced in talking around things, manipulating situations and people, wearing people down, writing policy that benefits them. Etc. They hold “training classes” for new Directors. Ridiculous. Sets the tone right away that they are the boss, they are in charge and they will make the decisions. Works for them every time. At the least, state legislatures would be unbiased and wouldn’t have the burden and conflict of having kids in the District, having work conflicts like working for one of our biggest vendors, Delta-t, (wow) and as ex teachers, the awkwardness of presiding over Administrators who will have to write a recommendation letter for employment for a Director at the end of the term. How can any of these Directors lead with no strings attached? They can’t and they and everyone before them and those that come after them can’t. It’s easier to just vote yes to everything the Administration wants.

I’m willing to give HB-76 a try. It can’t be worse.

It works wonderfully at UCF.

Keith,

Your smug arrogant statement that “it’s works wonderfully in UCF” says, I don’t care because it doesn’t happen to me. If that’s the case, why do you post here? I have grown to appreciate your comment and thought that you understood that decisions made by LM, Radnor, etc, (especially because many of us share the same Adminidtrstor supportive Solicitor) affect all of us. So, are you just a voyeur who likes to come in and watch so you can tell yourself, “I’m so glad that’s not me?” Because the way this is set up in all districts, it’s just s matter of time before it is you. You’re kidding yourself if you think otherwise. Go HB-76.

I’m sorry you interpreted my comment as being smug. My point was that some districts (I pointed out one) are well governed. Some are not. I believe TE was well governed in the not too distant past judging from the relatively low spending per student and the good academic results.

While I pointed to UCF as a good model today, it was headed in the wrong direction in 2005. That’s when a group of fiscally conservative citizens ran and got elected. It cycles and there is no impediment in TE that would prevent newly elected school directors from changing course at TE.

My dislike of HB76 stems from decision making at the state level. I like to drive decision making as local as possible. I can call my school directors; easily show up at a meeting and have an effect. They are my neighbors. Not so with my state officials.

Keith,

Thanks for your non-apology apology. It does not admit there was anything wrong with your remark and you even turn it around to imply that I am to blame for it.

TE was well governed until the not too distant past? What do you consider not too distant? I’ve been paying attention for around 8 to 10 years. Neal is the reason. Years and years ago he wrote a letter to the editor to the local paper called the Suburban. In it, he very well described how the main cost driver in the budget was employee salaries, benefits and especially pensions. God Bless Neal, Ray, Carol, Pattye Doug and Mike. They do a great job year after year explaining exactly what is going on in the budget, but look what’s happened and continues to happen.

When fiscally conservative citizens run for office in TE they aren’t elected and not because people turn out to vote against people who want to reign in wasteful budget spending. Voters have no idea who or what they’re voting for or against. There is a well oiled machine on the other side who gets her vote out, no matter what, just so they have that D after their name, that’s all that matters, and I tip my cap to her but it’s financially killing our District. You say, “it cycles” …..we’ve been in this “cycle for 13 years”, I don’t see this “cycle” turning around anytime soon. Scott Dorsey who got a big job with probably our biggest vendor, and says there’s no conflict of interest here, ran UNOPPOSED, that is outrageous. Todd K is running UNOPPOSED and who along with Roberta and ex teacher Kyle Boyer (and that’s no conflict either) want to raise our taxes to the max every cycle.

I would love to drive the decision making as local as possible. I would love to call my School Board Directors easily and show up at meetings and have an effect.

Even though they’re my neighbors, they say things like I’M SORRY IF YOU……bla bla bla

and they then go on to blame me for how I “interpret” their horrible decision making that only benefits them and Administrators and teachers.

They learn how to talk like that in their Administrator led “training clssses.” Sounds like you attended the same classes.

Go HB-76.

Personally, I’ve seen over the years several situations where the TE school board has been quite wasteful. Take for example the unnecessary fences that caused an amount of debate a few years ago. Thousands wasted in installation, in addition to wasted consultation costs what only stated back what the board and it’s safety reps had already tried to say. Safety was the key reason, but from what? The fences have open passage, not preventing anyone from entering and could contain students from rapidly dispersing, instead concentrating them to a few exit points. In my mind, making it more dangerous should we have a terrible disaster in the district. But the board had made up it’s mind, ignored the community’s comments, and did whatever it wanted anyway. This is only exemplified of part of the problem with irrational excessive spending. Another, which was finally reversed by the district, was the attempt to put lights on extended practice fields at the middle school. I had extended discussion with board members, who tried to tell me that the lights were needed to help student athletes compete. My position was to do what? How many actually go on to get college scholarships vs those who proceed to college with academic scholarships? How many become pros vs those who get professional degrees? Let’s be reasonable and focus on what the TE schools do best, along with the parents who expect excellence. And the board needs to be more open to finance decisions ad actions and inadequacies such as this last year’s problem in excess of $1 million. Ridiculous and irresponsible.

Mallam,

Thanks for your comment. The fences are a head scratcher to this day. I don’t think the Board knows why they pushed that through. It popped in a Directors mind, he proposed it and before you know it, they were committed to it but they didn’t know why.

It reminds me of the $4M to $6M maintenance building. Look what parents have to go through to get a $300,000 reading program…… they have to grovel and beg and cry and spend countless hours convincing the Administration and Board to approve it while the Board approves the construction of $6M maintenance buildings and salary increases on already outlandish salaries lickity split. When the decision benefits the Administration/teachers, the initiative is approved immediately. If it is something proposed by taxpayers or parents for the benefit of students, it is boggged down in a sea of molasses maybe to see the light of day only after piles and piles of guilt are heaped on parents about how the budget is so tight and we have no money for what they’re asking for. Ridiculois. How’s that maintenance building?

Taxpayer,

You are correct. I did not apologize for my statement nor do I feel any need to do so. Face to face communications prevents some of the misunderstandings inherent in chat room communications. Give me a call and we can arrange a meeting.

Here is why I think TE was reasonably well run. This is from 2012 showing excellent academic results with reasonable per student spending. With the last union contract (among other issues) I think TE is headed in the wrong direction.

Keith,

So you admit that I am correct that you did not apologize for your statement and that in fact you don’t feel the need to do so. Thanks for proving my point.

I can only surmise then that your passive aggressive comment, with no intent for remorse, was designed to further attack me and blame me for your insensitive remark aimed at our community.

I know it’s scary Keith, but we’re all in this togrther. UCF doesn’t have a free pass. You’re just like us, warts and all so instead of attacking us please join us in our fight for tax payer rights. Thanks for your informative comments that help our community as well as yours and all the rest.

I might call you for a meeting. I have to think about it. It was awfully big and nice of you to offer.

Taxpayer,

What’s with all this ad hominem stuff? Try to stick with facts and we can have a conversation. Also, you might want to come out from behind the pseudonym for credibility.

Keith,

You’re accusing me of what in fact you are doing. I am not attacking you by simply pointing out that by your own admission, your “apology” was not really an apology. Why all the smarminess? If you’re not sorry for your smug, arrogant, smarmy remarks, then don’t follow it up with a disingenuous smarmy non apology, “apology” when I call you out on it.