Keith Knauss, Unionville-Chadds Ford School District school board member, and regular contributor to Community Matters, has written ‘TE Contract Costing’ that may help us all better understand the teacher-school board contract negotiations process and the reasons for certain decisions. I thank Keith for his research and for sharing the information with us. I have provided an overview below along with my comments. (If you have a problem reading the numbers in the tables, click on the graphic and a larger version will open in a new window.)

In his opening remarks, Knauss states …

“ … Understanding contracts has taken on new importance since Act 1 of 2006. Previous to Act 1, school boards could negotiate contracts and raise taxes to whatever level was necessary to balance the budget. Since Act 1, many districts have had to, with great reluctance, reduce staff and programs to keep budgets within the limits of the ‘cap’.”

Employee compensation is the major factor determining the size of a school district budget and, subsequently the real estate tax rate increase. If the District budget is to be balanced under the restrictions of Act 1, close attention must be paid to the terms of the contracts.

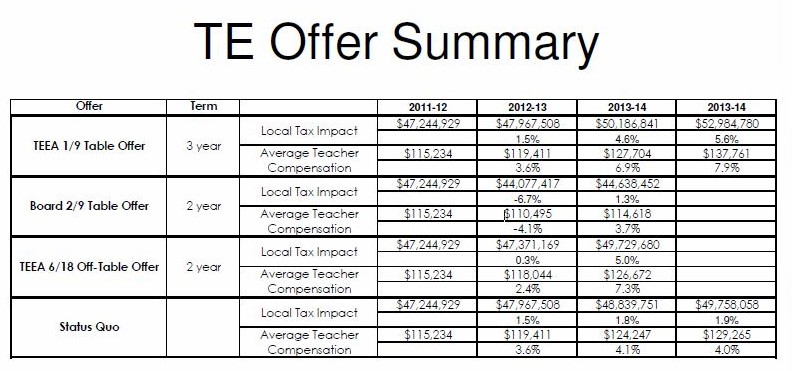

In the following table, Knauss presents the TE offer summary – the initial 1/9/12 offer by TEEA, the TE School Board 2/9/12 offer and TEEA 6/18/12 offer. The table indicates the average teacher compensation and taxpayer impact. According to Knauss, “The percentage increase in Average Teacher Compensation is more than the percentage increase of Local Tax Impact for 2 reasons … state subsidies and attrition.”

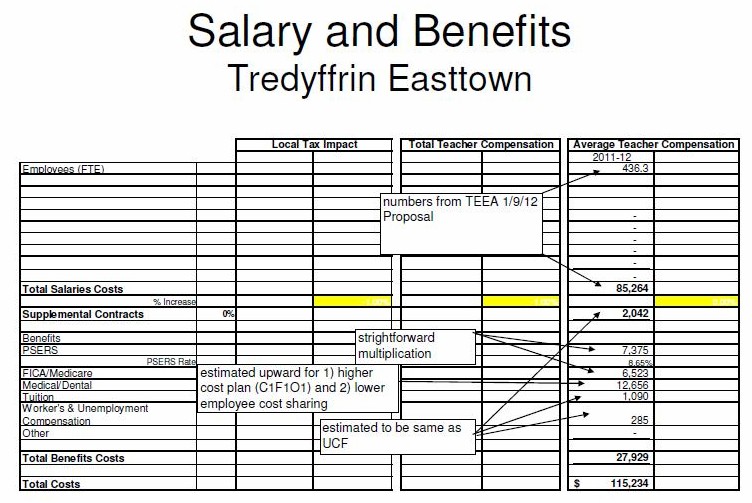

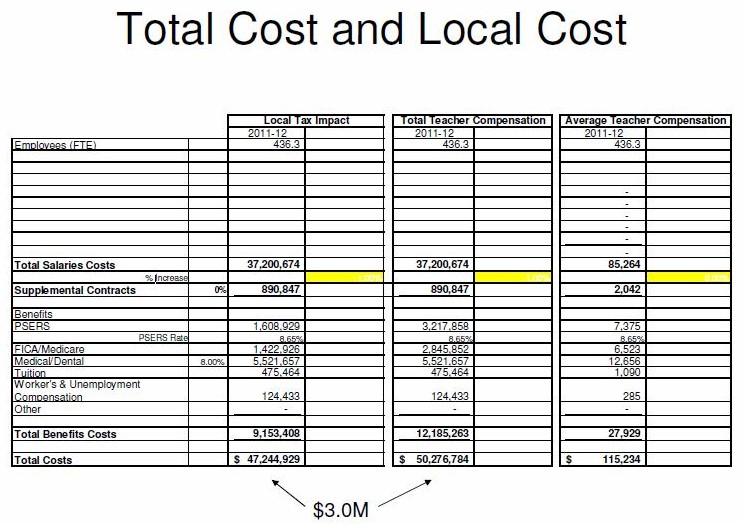

The following table reviews the salary and benefit packages of TE teachers. Krauss provides the approximate compensation (salary and benefits) for the average T/E teacher using the current teachers contract. The numbers are supplied by the District or are multiplications of the salary and the appropriate rate (PSERS and FICA).

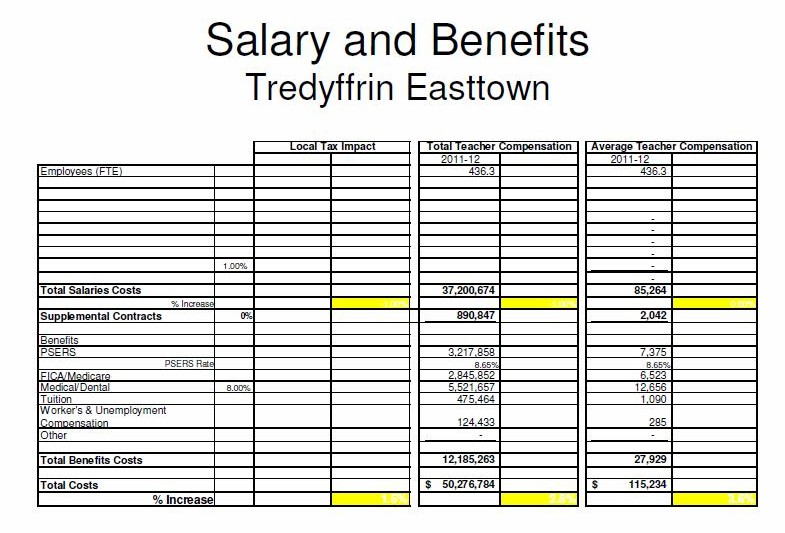

Knauss presents the following Salary and Benefit table, offering that the “… Total Teacher Compensation is a straightforward multiplication of the Average Teacher Compensation and the number of Employees. Total Teacher Compensation is the money taken from the taxpayers (local and statewide) for the services provided by TE teachers.”

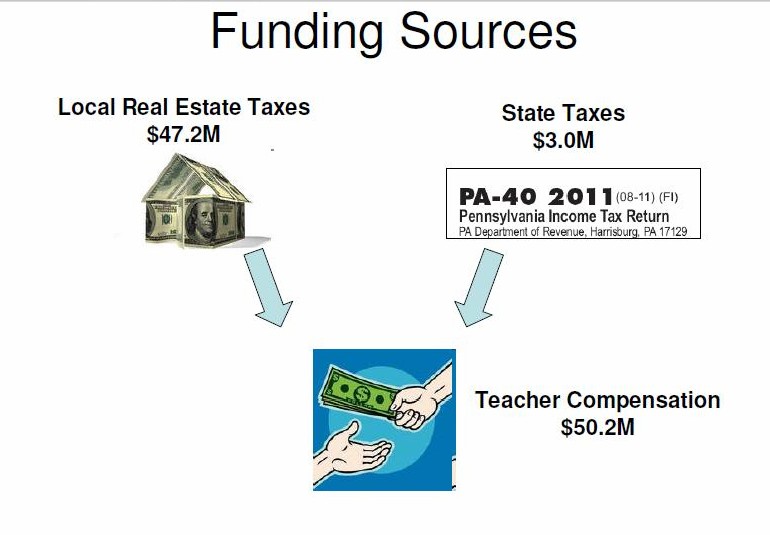

Here is an interesting graphic from Knauss, indicating the funding sources for teacher compensation. The major source of funding – local taxes and a secondary source of funding is from state and sales tax for half of PSERS and half of FICA.

Krauss looks at the effect of any contract settlement on the T/E taxpayers, and whether it can be financed within the Act 1 limits. He looks at two different costing methods – “One method looks at the total cost of the contract to all taxpayers, local and statewide; the other method looks at the cost of the contract to the local taxpayers to reflect the local tax impact of any other offer by ‘backing out’ the statement reimbursement for PSERS and FICA.”

The Local Tax Impact is calculated by “backing out” the state contributions to FICA and PSERS. Notice that the state contributes $3.0M in subsidies to lessen the Local Tax Impact.

————————————————————————————————-

When reviewing a teacher contract offer, Knauss supports the use of the following criteria:

- Is the offer economically sustainable under Act 1 limits?

- Are the compensation increases of the offer in line with the current economic climate?

- Is the compensation appropriate to attract and retain employees of quality?

Knauss answers a question that many have wondered … what happens if the teachers and the school board cannot reach a settlement? Due to substantial differences between TEEA and TE School Board, the union requested fact-finding by the PA Labor Relations Board. The independent fact finder will review both TEEA and TESD proposals and then make recommendations … however, remember the recommendations are non-binding.

The current teachers’ contract ends on Saturday, June 30. If an agreement is not reached, the teachers enter the “status quo” period, meaning that they continue to teach … to the expired contract. The teacher’s benefits and salary remain the same as in the expired contract. It is obvious that the School Board would not want an extended ‘status quo’ status for the teachers because it precludes any change to heath care benefits, compensation, etc. Knauss points out, that although the teacher compensation is frozen at its current level in ‘status quo’, legally the District must absorb any increases due to PSERS contributions or healthcare.

However, the situation is different from the teachers’ standpoint. During better economic times, the teachers would not want their contract settlement in ‘status quo’ state because working under the expired contract would mean that they would receive no additional compensation for years of service increase. But what choice do the teachers have?

According to TEEA website, the teacher’s last offer included a reduction in health care benefits and salary freeze for the first year. In their rejection of the union’s offer, the School Board instead asked the teachers to take a compensation reduction of $8,000 per teacher – which equates to as much as 13% for some teachers. There is little surprise that TEEA rejected that District’s offer, opting instead to go to the PA Labor Board. Why would the teachers want a new contract … status quo also keeps their current salary intact and preserves their current benefit package intact.

Knauss provides a multi-year analysis, assuming status quo and average compensation. He presents his analysis in several slides, giving us an idea of what certain scenarios would mean to the average taxpayer. To read Keith’s full report, click here.