At the time of the TESD budget passing in June the Business Manager claimed a projected $2M deficit for the year and … as a result, the taxpayers receive a tax increase. Fast forward and less than four months later and this same business manager tells the school board at the October Finance Committee meeting tonight (agenda attached) that not only did the District not have a deficit but instead magically had a surplus of $3.1M! Why Does This Keep Happening??

Folks, this happens yearly – the business manager presents fictitious deficit budget to the school board – the school board votes for a tax increase (17 straight years!) – and then millions are magically found in surplus. This is not a financial pandemic anomaly — just like the yearly tax increase, the surplus happens year after year. If you don’t believe me, go to the top left on Community Matters homepage and enter “budget surplus” in the search bar – and you will see how this “new math” style of budgeting and increasing taxes has gone on for years with the Business Manager.

In advance of tonight’s Finance Meeting, I received the following email from Keith Knauss, former Unionville-Chadds Ford school board member. As noted by Keith, this is the third year in a row of a budgeting error — the budget surplus and resulting inaccurate taxing of residents did not happen as a result of the pandemic … it’s a yearly event!

After reading Keith’s analysis, I think you will agree that voters need to support school board directors with strong accounting backgrounds in the upcoming Nov. 2 election! (There are 4 seats available on the school board — please vote for candidates that understand finance and the budget process and that will hold the Business Manager accountable.)

Email from Keith Knauss, dated 10/10/21 (with his permission):

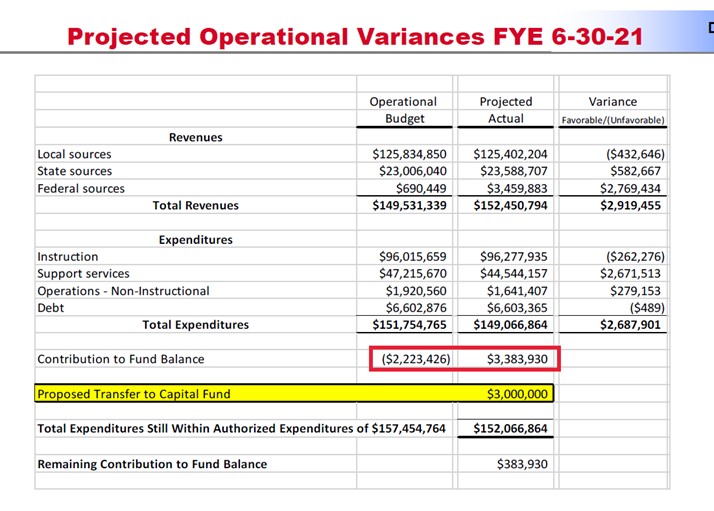

The agenda for the upcoming Finance Committee contained the following slide comparing the Original Budget for 2020-21 to the Projected Actual. (we’ll get the audited numbers next month)

Mr. McDonnell misled the board in June 2020 when the Original Budget was passed with a 2.6% tax increase. Mr. McDonnell told the board and public that even with a tax increase of 2.6% the district run a deficit of $2,223,426 (outlined in red) and the deficit would have to covered by withdrawing money from the Fund Balance. Well, lo and behold, the district actually ended up with a $3,383,930 surplus instead of a $2,223,426 deficit!

Why does this matter? Shouldn’t everyone be happy that we have a surplus rather than a deficit? There are two problems.

1. Had Mr. McDonnell estimated revenues and expenses correctly the board and public could have contemplated a lower tax increase, or no tax increase at all. The 2.6% tax increase only brought in $3M. Thus, the district could have had a balanced budget with no tax increase at all. Instead, Mr. McDonnell presented the board and public with a fictitious deficit budget which induces the board to enact the maximum tax increase possible.

While a one-year budgeting error would be excusable due to unforseeable circumstances, this the third year in a row where a deficit was predicted, but a significant surplus was realized ($4.5M and $6.0M) making the tax increases for the past three years questionable.

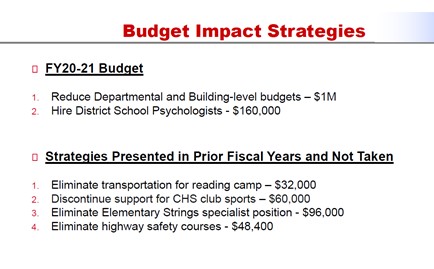

2. Had Mr. McDonnell estimated revenues and expenses correctly the board and public could have dispensed with the ritual of Budget Impact Strategies that unnecessarily decrease the educational experience of the students. Why cut student services if a cut is not needed? A representative slide is included below.

The bottom line:

The administration provides the board and public with estimates of revenues and expenditures during the budget process. The job of the board with input from the public is to balance the budget by either increasing revenue through taxation and/or decreasing expenses by cutting programs.

If the revenue and expenditure numbers provided by the administration are false and unreliable either because of ignorance, or worse, by design then informed decisions on taxation and programs are impossible. The administration has for the past 3 years skewed budget estimates in a direction (underestimated revenues; overestimated expenses) designed to present a false picture of financial distress leading to over taxation.

I’ll also note that the board is contemplating a $3M transfer from the General Fund to the Capital Fund to be back-dated into the fiscal year that ended last June 30th. This is illegal as per School Code:

Section 687. Annual Budget; Additional or Increased Appropriations; Transfer of Funds.

…

(d) The board of school directors shall have power to authorize the transfer of any unencumbered balance, or any portion thereof, from one class of expenditure or item, to another, but such action shall be taken only during the last nine (9) months of the fiscal year.

If the board wanted to transfer funds to be recognized in the 2020-21 fiscal year, they should have made the motion before June 30th. The board can transfer the $3M from the General Fund to the Capital Fund now, but the transfer must be recognized in the current fiscal year not in the fiscal year that has already ended.

Keith Knauss