What is the saying about no do-overs in life? For approximately 25 non-instructional aides in the TE School District, they learned yesterday that do-overs are possible!

What is the saying about no do-overs in life? For approximately 25 non-instructional aides in the TE School District, they learned yesterday that do-overs are possible!

To the surprise of many, you may recall on April 30, members of the Tredyffrin Easttown Non-Instructional Group (TENIG) voted against including the small group of “non-instructional” TESD aides into their union. The bid to create a subset group within the TENIG union for the District’s non-instructional aides failed with a vote of 23-21. Although there are approximately 170+ TENIG employees, only 44 members attended the meeting to vote.

In the aftermath of the April 30 vote, some members of TENIG rallied behind their fellow District employees and mounted a campaign for another vote; a vote that would include absentee votes. The collective bargaining rules require a simple majority — a vote of fifty percent plus one of the votes cast. The election results are in and the TENIG vote count to include the 20+ District aides is 53 Yes – 13 No. The results indicate an overwhelming majority of the TENIG union members want their fellow District employees!

With the District’s deadline of May 15 (tomorrow) to outsource the full-time aides and paraeducators to CCRES, this news for the non-instructional aides could not come at a better time. The saga of the District’s full-time aides and paraeducators and the threat of outsourcing have gone on for the last two years.

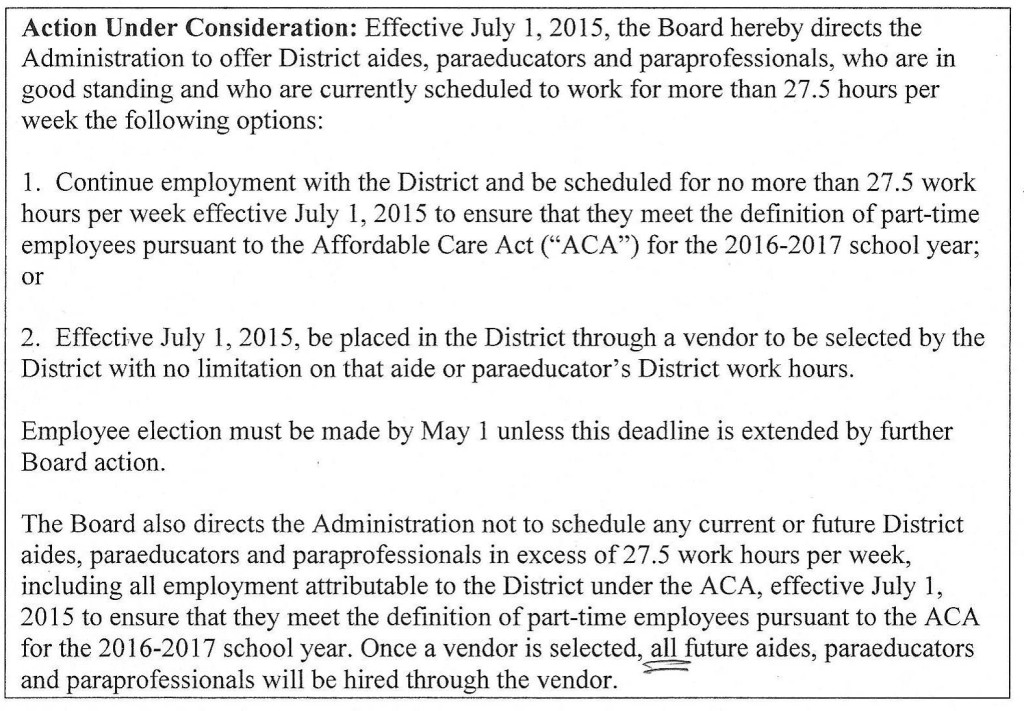

Faced with offering health care benefits to all District employees under Affordable Care Act or paying penalties for non-compliance, the School Board had made the decision earlier this year to outsource. The 73 full-time aides and paraeducators were given the option of either working for the outsourcing company to keep their full-time hours or reducing their hours to part-time (27.5 hr. and below) and remain a District employee. The District employees had until May 15 to make their decision.

Although the outsourcing of the District’s full-time aides and paraeducators would have avoided the cost of providing health care and PSERS, the Board’s plan has a new wrinkle. The current 3-year TENIG contract (July 1, 2014 to June 30, 2017) provides for health care benefits for all employees working 25 hours or more per week and as District employees, they receive PSERS. Approximately 25 of the District’s non-instructional aides destined for outsourcing now will have a new home in the TENIG and enjoy the benefits of a collective bargaining group, which includes health care!

Although some steps remain in the process to formally add the non-instructional aides in to TENIG, the hard work has been done. Congratulations to John Brooks, TENIG president and to the many TENIG members, who supported their fellow District employees, appreciated their value and fought to save their District jobs!