Last week I was contacted by Laura McCrystal, a writer with the Philadelphia Inquirer asking about TESD’s recently approved tax increase of 3.9%. Although she was very aware of our District’s ongoing saga over the $1.2 million accounting error, Laura was clear that the article she was working on was specific to greater Philadelphia area school districts and a comparative analysis of school taxes.

Last week I was contacted by Laura McCrystal, a writer with the Philadelphia Inquirer asking about TESD’s recently approved tax increase of 3.9%. Although she was very aware of our District’s ongoing saga over the $1.2 million accounting error, Laura was clear that the article she was working on was specific to greater Philadelphia area school districts and a comparative analysis of school taxes.

For the record, the $1.2 million accounting error caused by the District’s delayed payment of a special ed invoices remains an open issue. Although the school board acknowledged and voted to correct the error with the PA Department of Education, as of the last school board meeting it had not yet been done.

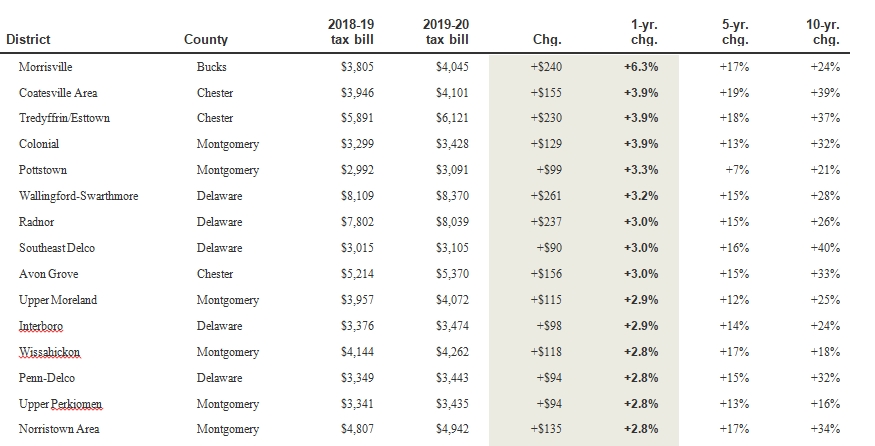

The Philadelphia Inquirer published its article, “How much are your school taxes increasing? Here’s a district-by-district look at the Philly region” which is a fascinating read — and analysis of tax increases in the region. Although the T/E School District generally like to come in at first place, on the tax increase list we tied for second highest increase! Yes, our District received the distinction of the second highest tax increase (3.9%) in the greater Philadelphia region – second only to Morrisville School District in Bucks County with a 6.7% tax increase. (If you recall, the T/E School Board had originally passed the proposed final budget (5-4 vote) in late April with a 6% tax increase which was later reduced to 3.9% in June.). Below shows the highest tax increase school districts:

In discussion with the Philadelphia writer, I was asked about the impact of rising taxes on the community. As was stated in the article, I worry “ about a lack of scrutiny on the school budget and its rising taxes because so many residents move to the district so that they can send their children to its high-performing schools. “There are some who are inclined not to be concerned about the taxes that are being paid because they feel like the value they get offsets that,” she said. “But I think part of the problem is that as a result of people moving here for the school district … the budget process is not scrutinized as much as it would be.”

I expressed concern that our school district tax increase is not an isolated one year increase – but that we should look at our tax increases year after year. As was stated in the article, I have been tracking the tax increases in T/E School District for the last 15 years and you need to go all the way back to the 2004-05 year for the last zero tax increase! Looking at the chart above, you see that our District has had an 18% tax increase over the last 5 years and a whopping 37% during the last 10 years.

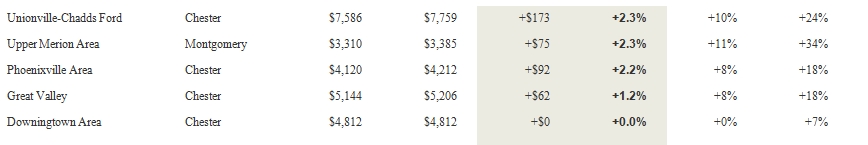

I excerpted neighboring school districts Unionville-Chadds Ford, Upper Merion, Phoenixville, Great Valley and Downingtown from the Philadelphia Inquirer chart.

Looking at nearby Great Valley School District, they are keeping taxes significantly lower than T/E with a 1.2% tax increase for 2019-20 school year, 8% increase for 5 years and 18% increase for 10 years. Great Valley is another high achieving school district with similar performing students, special ed needs, rising pension costs, etc. so what accounts for the dramatic tax difference between GVSD and T/E?

But look at Downingtown Area School District! According to Niche, Downingtown Area School District has 12,656 students in grades K-12 with a student-teacher ratio of 15 – 1 and according to state test scores, 69% of students are at least proficient in math and 85% in reading.

Some will argue that Downingtown Area School District is not in the highest performing echelon of area school districts (like T/E, Unionville-Chadds Ford, Lower Merion or Great Valley) but they operate ten elementary schools, three middle schools and three high schools and somehow manage to have a ZERO tax increase for 2019-20, ZERO tax increase for the last 5 years and only 7% tax increase for the last 10 years.

Downingtown is operating a large school district that has rising pension costs and increased special ed expenses like all the other school districts, yet successfully delivers zero tax increases to their residents year after year.

I’m not suggesting that we all move to Downingtown School District but there should be some kind of balance — why is it that as residents of the T/E School District we are faced with significant tax increases year after year?

Families move to the T/E community for the school district and are generally satisfied as long as the high test scores are maintained. As a result, there is a certain complacency when it comes to the District’s budget and our ever-increasing taxes. Guess the question becomes, how long are these yearly tax increases sustainable by the District’s taxpayers?