Last week a tentative agreement was reached between Lower Merion School District and their teachers. The deal between LM and the union was made in secret, with a process devoid of transparency. The proposed teacher’s contract and its terms were not published for public review.

There are rumors that the TE School District is currently in ‘Early Bird’ contract negotiations with the teacher’s union. Because of the existing situation in Lower Merion, rumors of early bird talks and five seats on the TE School Board up for grabs on Election Day, there was discussion as to where our candidates stand on this issue. The following email was sent to the ten Tredyffrin and Easttown school board candidates on Saturday.

To All TE School Board Candidates:

I know that you are all very busy campaigning in advance of Election Day. Tredyffrin resident Ray Clarke added a comment on Community Matters regarding the teacher contract, negotiations and keeping the public informed. He has spoken with several of you regarding his concerns, particularly given what is currently going on in Lower Merion School District. As a result, I am asking you to read the following and provide a very brief (100 words or less) response to me by 9 PM, Sunday, Nov. 1. The question and all candidate responses received will appear on Community Matters on Monday, Nov. 2.

Negotiating union contracts (teachers and support staff) will be important tasks for the new Board. In Lower Merion School District, a secret deal is playing out between their school board and the teachers union. Much to the chagrin of Lower Merion taxpayers, the union members get to review the contract before signing but the public is left in the dark and provided no information.

During the last teachers’ contract negotiations, the TE School Board moved in the correct direction with periodic updates to the public. Assuming that there are no secret “Early Bird” deals already in discussion between the current Board and the union, [if elected] where do you stand on publishing any proposed contracts to the public at the same time as the unions send it to their members? In addition to publishing the terms of the contract to the public before signing, to also include the full annual cost of the contract for each year (including PSERS, salaries, benefits, etc.) with an explanation of how the Board will pay the costs.

Again, I understand that you are pressed for time and I thank you in advance. Your responses may help get additional voters to the polls on Tuesday.

Pattye Benson

Because I know how busy the candidates are in the last days leading up to the election, their responses were to be brief – 100 words or less. One hundred words is very short; the second paragraph in the statement above (from “During … costs.”) is 109 words.

During this campaign season, most every school board candidate has used themes of transparency, public engagement and responsiveness to citizens in their campaigning literature, meet and greets with voters and during the Chester County League of Women Voters candidate forum. It is for that reason, that a brief response would allow each candidate the opportunity to restate and to reconfirm their transparency commitment to the voters before Election Day tomorrow (November 3).

Of the ten school board candidates, responses to the question were received by Kate Murphy (R) and Fran Reardon (D), Easttown, Region 3 candidates; Neill Kling (R) and Neal Colligan (R) Tredyffrin East, Region 1 candidates and Ed Sweeney (R) Tredyffrin West, Region 2. The responses from these five candidates appear below.

The four Democratic school board candidates from Tredyffrin (Alan Yockey, Michele Burger, Roberta Hotinski and Todd Kantorczyk) each sent similar emails; all declining to respond, citing time constraints due to the campaign and/or previous personal commitments. There was no response from Kris Graham. If, as rumored (and I do say if) there are early bird negotiations already underway between the TE School District and TEEA, the District teacher’s union, it would not be possible for Ms. Graham to respond.

The TE School Board candidate responses are as follows:

Neill Kling, Tredyffrin East, Region 1 candidate:

A cloak and dagger approach serves neither party. The union must understand throughout that what their members receive can be no more than what our tax base will reasonably be able to bear. The current PESERS situation resulted from disregard of that sound principle. Thus, I believe that the taxpayers should view the contracts when they are sent to the teachers for approval. I am also in favor of providing a public estimate of how we propose to meet the contractual obligations. The District must conduct negotiations with this estimate uppermost in mind. Publishing it when they are completed is responsible stewardship.

Neal Colligan, Tredyffrin East, Region 1 candidate:

Of course, the public should be informed as negotiations move forward….this is by far the largest municipal contract in our community. Start now by presenting the existing economics…total salary, benefits, pension contribution…show the history of these costs. This information, reviewed at an entity level, will not disclose any employees’ personal compensation package and will not violate the rules of new contract discussions. As the process advances, let the community know of the issues…I doubt the Union side would object. People here are pretty fair and can draw their own conclusions on what is just as negotiations move towards a new contract.

From Ed Sweeney, Tredyffrin West, Region 2 candidate:

I would strongly agree to the first proposal if it was consistent with current agreement between the School District and the Union and with the provisions of relevant labor law. As far as his other proposals, I need more information but I am a proponent of maximum disclosure at the appropriate time.

I agree with the principle of “MORE” . . . more transparency, more public disclosure, more committee meetings convenient to working parents, and more involvement of residents and stakeholders at an early stage of committee consideration of issues. In my view, more = better. More increases public confidence and protects the taxpayer.

From Kate Murphy, Easttown, Region 3 candidate:

In Pennsylvania, salaries and benefits make up the lion’s share of any school district’s budget, generally between 70% and 80%. Pension benefits (PSERS) are set legislatively by the General Assembly and the Governor, and are not negotiated by local school boards. All collective bargaining agreements must be available to the public for review and comment well in advance of the public vote to approve such agreements. Periodic updates during the negotiations can be a helpful tool to inform the public. District estimates of the full annual cost of the contract for each year should be available for timely public examination.

From Fran Reardon, Easttown, Region 3 candidate:

In negotiating contracts within the School District, we should maintain a high level of transparency for all parties involved. Periodic updates should be available to the taxpaying public and all other stakeholders. Current annual cost of contracts should clearly be given with the long term effects of PSERS obligations also laid out and presented to the TE community in a timely fashion before any vote by the school board.

As a member of the TE School Board, I will work with the full board to give the taxpayers value for their dollar and also maintain the excellence of our schools.

I was contacted by Maggie Gaines about an upcoming FREE educational inclusion and diversity series for parents, teachers and administrators. A District resident, Maggie is one of the leaders of BUILD T/E and a mother of two, including first-grader Margot, who has Down syndrome. (You may recall, the District made national headlines last year when the police were called about a supposed “threat” Margot made to her kindergarten Special Ed teacher.)

I was contacted by Maggie Gaines about an upcoming FREE educational inclusion and diversity series for parents, teachers and administrators. A District resident, Maggie is one of the leaders of BUILD T/E and a mother of two, including first-grader Margot, who has Down syndrome. (You may recall, the District made national headlines last year when the police were called about a supposed “threat” Margot made to her kindergarten Special Ed teacher.)![]()

If you are a parent of a child with disabilities and learning differences (or a teacher or administrator) you will want to consider this opportunity. The PA Inclusive Collective series consists of four 90-minute sessions through the month of February presented by three of the foremost leaders in inclusive education. These sessions would typically cost $100 per person but with grant and resource funding are FREE! However, you do need to sign up to participate.

If you are a parent of a child with disabilities and learning differences (or a teacher or administrator) you will want to consider this opportunity. The PA Inclusive Collective series consists of four 90-minute sessions through the month of February presented by three of the foremost leaders in inclusive education. These sessions would typically cost $100 per person but with grant and resource funding are FREE! However, you do need to sign up to participate. At the TESD meeting on June 8, the public learned that in addition to a 2.6% tax increase and administration salary increases, the school board’s approval of the budget included the suspension of ERB testing for the 2020-21 school year.

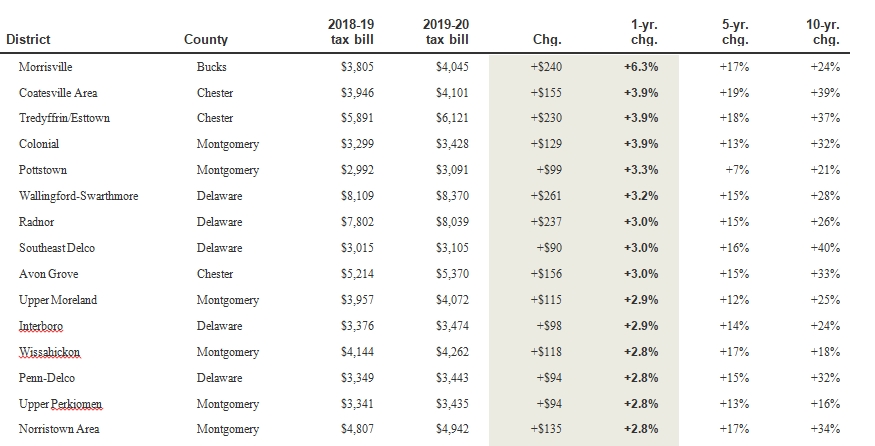

At the TESD meeting on June 8, the public learned that in addition to a 2.6% tax increase and administration salary increases, the school board’s approval of the budget included the suspension of ERB testing for the 2020-21 school year.

Yesterday was a big win for taxpayers in the Lower Merion School District.

Yesterday was a big win for taxpayers in the Lower Merion School District.

A significant decision in the

A significant decision in the

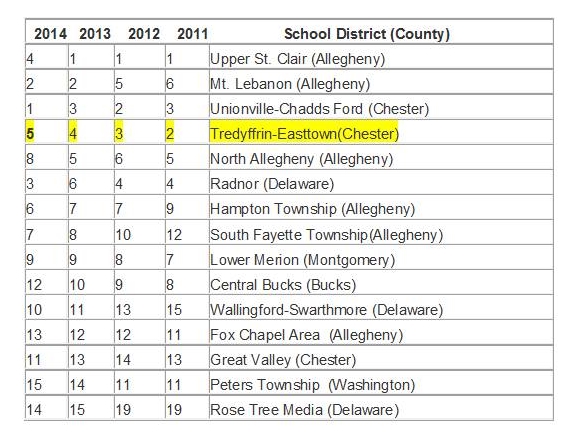

There is an opt-out movement against standardized testing in public schools playing out across the country. Opponents of the exams argue that too much time in public education is spent teaching to the test, stressing out students and teachers and detracting from real learning time. Locally, the anti-standardized testing is gaining traction among parents in Lower Merion, Radnor and Tredyffrin Easttown School Districts – just as the Pennsylvania school district PSSA standings for 2015 are released.

There is an opt-out movement against standardized testing in public schools playing out across the country. Opponents of the exams argue that too much time in public education is spent teaching to the test, stressing out students and teachers and detracting from real learning time. Locally, the anti-standardized testing is gaining traction among parents in Lower Merion, Radnor and Tredyffrin Easttown School Districts – just as the Pennsylvania school district PSSA standings for 2015 are released.