T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website, www.tesd.net.

T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website, www.tesd.net.

Last chance to have your voice heard as the clock ticks down – Send your public comment to the school board at virtualboardcomment@tesd.net If you sent a comment prior to the June 1 Finance Committee, I suggest that you send another comment! Comments must reference Priority Discussion topic Final Adoption of the 2020-21 Budget and must be received before 6 PM on Monday, June 8. Make sure you include your name and township of residence (Tredyffrin or Easttown).

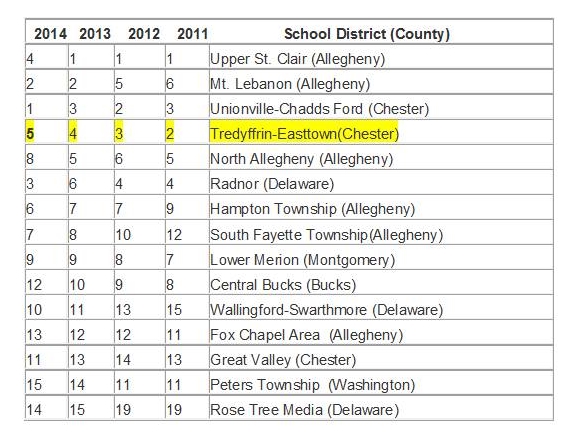

As it now stands, the District budget includes a 2.6% tax increase – the largest increase permitted by Act 1 guideline. Should the School Board approve the 2020-21 budget with a tax increase, it will mark sixteen straight years of a tax increase to the District’s residents. How does the School Board respond to raising property taxes to people who are losing their incomes?

At a time when residents have lost their jobs, and every segment of our economy, including our local small businesses, are feeling the effects of the pandemic, could the School Board at the very least ensure no increase in property taxes. Most all of us are finding ourselves in worse financial shape — freezing property taxes for District residents should be more than a nice thought!

At the Finance Meeting on June 1 (click here for video), it was obvious that I was not alone in my concern about the proposed tax increase. At the end of the meeting [and only stopping because of video time constraints] at least twenty-five resident comments were read — and all but a couple asked for no tax increase and/or no to the elimination of ERB testing.

To his credit, Scott Dorsey has remained a constant, the only school board director who echoed the words of residents and asked for a zero tax increase in the 2020-21 budget! Thank you Rev. Dorsey for understanding that we are all suffering because of the Covid-19 crisis and that now is not the right time to raise our property taxes. Two other board members, Michele Burger and Mary Garrett Itin, asked for a 2% tax increase with the remaining six members apparently in favor of a 2.6% tax increase.

As noted in the 2020-21 budget agenda materials (see pgs. 311- 314), the School Board will vote on salary increases and bonuses for the District’s administration, supervisory and confidential employees. Thank you to resident Ray Clarke for providing commentary on the proposed employee increases:

Once again, the final fiscal year Board materials contain proposed salary increases and bonuses for Administration, Supervisory and Confidential employees.

And, as usual, there is no information provided to allow the Board to assess the appropriateness of the increases, and perhaps we now see the reason why.

Increases have moderated this year, but the increases for employees in all these categories still add $141,987 to the annual budget, moderated a little by the replacement of some Supervisory/Confidential personnel by lower paid employees. The straight average of increases for personnel in place both last year and this is 2.25%. Increases are mostly in the 2% to 2.5% range, with the maximum of the Act 1 Index 2.6% being received by a few.

Note that the total of Administration increases still exceeds the 1.7% stipulated in the Act 93 contract. At a time when other school districts are freezing salaries, it seems unlikely that this exceptional increase is required by “the competitive job market”.

However, there is one exception to the Index limit, and that is listed only in the Employment Agreement section of the TESD website. No increase comes close to Business Manager Art McDonnell’s 3.1% annual increase to $216,427/year, stipulated by contract, regardless of the Act 1 Index, inflation, or taxpayers’ ability to pay. This increase is worth $6,507, and amounts to 4.6% of all the salary increases.

These increases average at about $2,000 a year for Supervisory/confidential personnel and $3,500 for Administration. I hope that the Board considers the appropriateness of these substantial additional payments at a time of such economic uncertainty.

Adding insult to the residents, who are struggling in the midst of an uncertain future and a proposed 2.6% tax increase, is that the School Board would consider salary increases that exceed the Act 93 contract for administration, supervisory and confidential employees. And further, that TESD Business Manager Art McDonnell will receive the highest salary increase, +3.1%!

There are school districts in Pennsylvania that are freezing employee salaries as a cost-savings measure for 2020-21. Not only is TESD not freezing the salaries, the Board’s vote to approve will increase salaries above the contractual agreement. School Board, how is this possibly fair to the taxpayers?

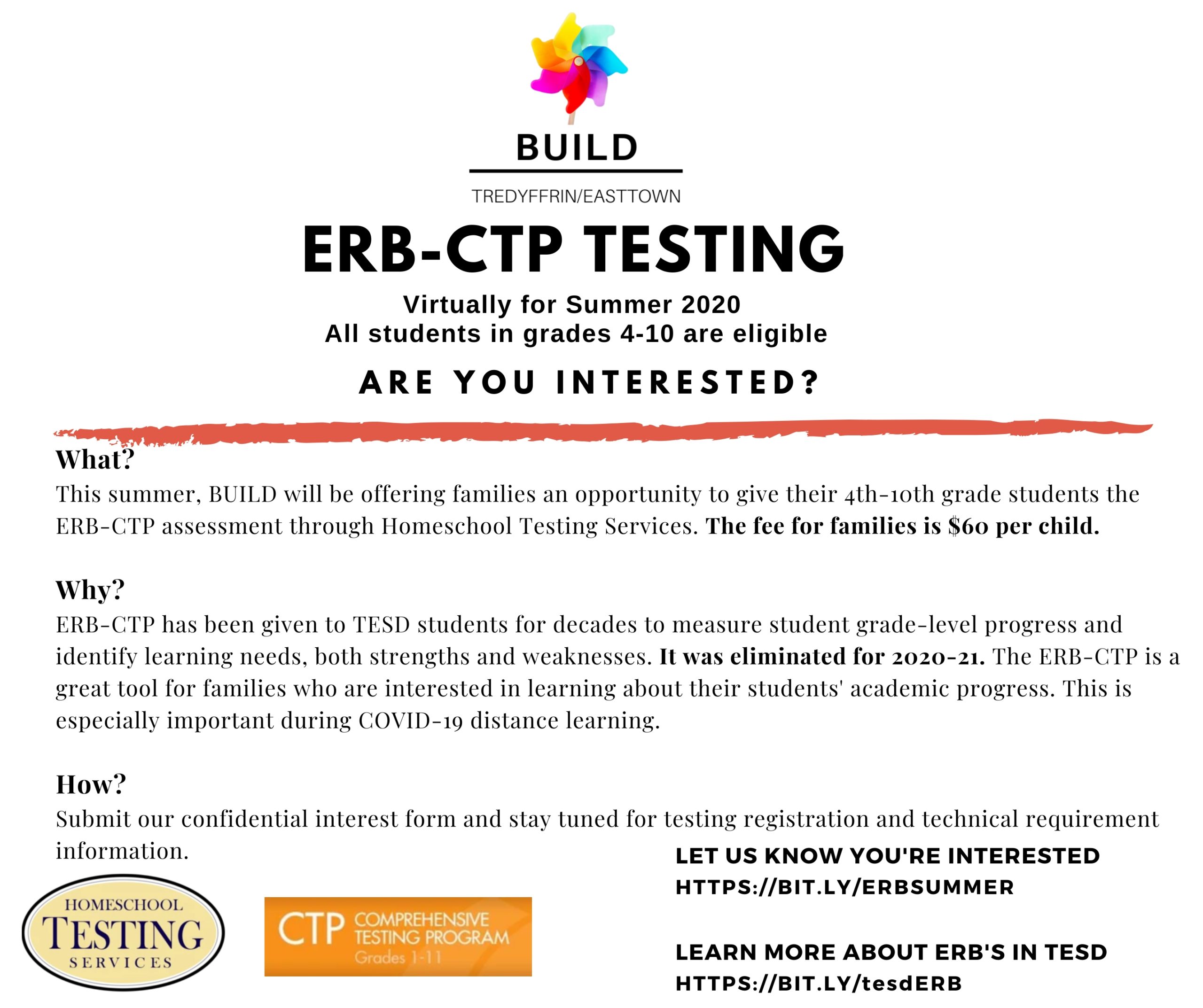

The administration, supervisor and confidential employee increases will add $142K to the District 2020-21 budget with no discussion to freeze the salaries for one year. Yet on the other hand, the proposed budget includes the elimination of ERB testing to save $85K as a cost-savings measure. Budget savings should not come at a cost to our students!

A form of assessment to guide instruction and reading, ERB testing has been used in TESD for many years to measure students’ progress and to identify the strengths and weaknesses of the District’s curriculum. TESD has no other tests that give grade level snapshots of students’ performance in reading and math – it is the only test of its kind!

ERBs are particularly important given the distance learning challenges faced by District families because of Covid-19. Parents need to know that their children are on track academically and many support the continuation of ERB testing as evidenced by the number of comments previously received by the District.

BUILD T/E, an advocacy organization in TESD for parents of children with learning differences, fully supports ERB testing in the District and opposes its elimination in the 2020-21 budget. Click here for BUILD’s latest blog post concerning the proposed elimination of ERBs in budget.

Do you have a comment for the School Board regarding the 2020-21 budget? Do you OPPOSE a 2.6% tax increase? Do you OPPOSE the elimination of ERB testing? Have a comment about employee salary increases in the proposed budget?

Send your comments to the School Board NOW — email the comments to Virtualboardcomment@tesd.net. If you sent a comment prior to the June 1 Finance Committee meeting, I suggest that you send another comment!

Comments must reference Priority Discussion topic Final Adoption of the 2020-21 Budget and must be received before 6 PM on Monday, June 8. Make sure you include your name and township of residence (Tredyffrin or Easttown).

I was contacted by Maggie Gaines about an upcoming FREE educational inclusion and diversity series for parents, teachers and administrators. A District resident, Maggie is one of the leaders of BUILD T/E and a mother of two, including first-grader Margot, who has Down syndrome. (You may recall, the District made national headlines last year when the police were called about a supposed “threat” Margot made to her kindergarten Special Ed teacher.)

I was contacted by Maggie Gaines about an upcoming FREE educational inclusion and diversity series for parents, teachers and administrators. A District resident, Maggie is one of the leaders of BUILD T/E and a mother of two, including first-grader Margot, who has Down syndrome. (You may recall, the District made national headlines last year when the police were called about a supposed “threat” Margot made to her kindergarten Special Ed teacher.)![]()

If you are a parent of a child with disabilities and learning differences (or a teacher or administrator) you will want to consider this opportunity. The PA Inclusive Collective series consists of four 90-minute sessions through the month of February presented by three of the foremost leaders in inclusive education. These sessions would typically cost $100 per person but with grant and resource funding are FREE! However, you do need to sign up to participate.

If you are a parent of a child with disabilities and learning differences (or a teacher or administrator) you will want to consider this opportunity. The PA Inclusive Collective series consists of four 90-minute sessions through the month of February presented by three of the foremost leaders in inclusive education. These sessions would typically cost $100 per person but with grant and resource funding are FREE! However, you do need to sign up to participate. Like many school districts in America, the T/E School District started the 2020-21 school year virtually. No one thinks virtual classrooms are as good as the real thing, but they were a necessity to fight the pandemic. In the stressful era of Covid-19, the re-imagining of education is no easy task for students, parents or teachers.

Like many school districts in America, the T/E School District started the 2020-21 school year virtually. No one thinks virtual classrooms are as good as the real thing, but they were a necessity to fight the pandemic. In the stressful era of Covid-19, the re-imagining of education is no easy task for students, parents or teachers. At the TESD meeting on June 8, the public learned that in addition to a 2.6% tax increase and administration salary increases, the school board’s approval of the budget included the suspension of ERB testing for the 2020-21 school year.

At the TESD meeting on June 8, the public learned that in addition to a 2.6% tax increase and administration salary increases, the school board’s approval of the budget included the suspension of ERB testing for the 2020-21 school year.

Because of Covid-19, we can probably all agree that distance learning proved challenging for school districts, parents and students across the country and that TE School District is no exception. This for some TESD parents makes the long-valued ERB assessment more important as a means to gauge their child’s learning during the past year.

Because of Covid-19, we can probably all agree that distance learning proved challenging for school districts, parents and students across the country and that TE School District is no exception. This for some TESD parents makes the long-valued ERB assessment more important as a means to gauge their child’s learning during the past year.

The voices of Tredyffrin Easttown School District residents were unified in their message to the school board. It took the District solicitor 1-1/2 hours to read into public record

The voices of Tredyffrin Easttown School District residents were unified in their message to the school board. It took the District solicitor 1-1/2 hours to read into public record  T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website,

T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website,