The countdown is on for the final approval of the TESD 2021-22 budget. At the finance committee meeting on Monday, June 7, 7 PM, the budget specifics will be reviewed, and the school board will vote on the District’s 2021-2022 final budget and property tax rate at the June 14 regular board meeting.

The countdown is on for the final approval of the TESD 2021-22 budget. At the finance committee meeting on Monday, June 7, 7 PM, the budget specifics will be reviewed, and the school board will vote on the District’s 2021-2022 final budget and property tax rate at the June 14 regular board meeting.

It is unclear why the upcoming finance committee meeting on June 7 remains virtual but that the school board meeting on June 14 is in-person at the high school!

In early 2021, the school board voted to approve a resolution certifying that the tax increase for the 2021-22 budget will be 3% or lower. Should the District’s final 2021-2022 budget include any tax increase, it would mark the 17th straight year of tax increase to its residents.

As the 2021-2022 budget process moved forward this year, there are board members committed to a zero tax increase – most notably Scott Dorsey. On flip side, there are school board members who favor the highest tax increase possible. Although Scott has championed the zero tax increase cause during his tenure on the board, he (and the taxpayers) never enjoyed majority support.

To watch the video of the May finance committee meeting, click here. About three hours into the meeting (watch at 3.04.40 – 3.04.50) a finance committee member comments that the state says we are “not taxing enough” to our residents. All I can say is thank goodness for the Act 1 index which limits our maximum tax increase.

We saw what happened last year – amid the pandemic most of the board ignored the public and voted instead for a tax increase! Will the vote on June 14 finally break the cycle of the annual tax increase? We’ll know in a couple of weeks, and in person!

For those of you that follow Community Matters, you will recognize the name Keith Knauss as a regular contributor. Keith is a former school board director of Unionville-Chadds Ford School District, serving for many years, several as its president. UCFSD and TESD share striking similarities in rankings, test scores, etc. As a result, Keith follows our District, particularly its budget process and sent a detailed email regarding finances to the TE School Board last week.

Keith provided me a copy of his email titled “District Financial Programmatic Decisions Based on Quicksand” offering that it could be shared on Community Matters (see below). His message is clear and direct to the school board but will it make a difference? Keith points out that all deliberations, by law, must be made in public so that the public can provide feedback. Wouldn’t it make sense to have the June 7 finance committee meeting in person!? Did any of the school board bother to respond to him?

District Financial and Programmatic Decisions Based on Quicksand

To: TE School Directors

From: Keith Knauss

This note may help you with your current budget deliberations.

Each year your administration presents the board with revenue and expense numbers for the upcoming school year. They are supposedly their best estimates of revenues the district will collect and the expenses that will be used for the education of the children over the next fiscal year. Your job, which you’ve already begun, is to bring the budget into balance by either cutting programs to reduce expenses or increase revenue by either increasing taxes and/or user fees. Your deliberations, by law, must be made in public so the residents can provide feedback.

- Currently, you and the public have been presented with budgeted revenues (before any tax increase) of $150.2M.

- You and the public have been presented with budgeted expenses of $156.7M.

- That leaves you with a $6.5M hole to fill to achieve a balanced budget.

- That’s a pretty large hole to fill and the situation cries out for you to raise taxes to the maximum amount allowable (3%) to bring in an additional $3.6M to partially fill that $6.5M hole.

- In the end, after raising taxes by 3% you’ll close the budget gap by using $3M from your savings account which is officially called the Fund Balance.

In summary: The administrators, using their wisdom and experience, supposedly gave you and the public

their honest estimates of revenues and expenditures for the next fiscal year. You are deliberating before the public on tax increases, user fees, program cuts and use of savings based on those budget numbers.

But what if the administrators are not very good at estimating or, worse, are purposefully presenting a false financial picture? What if the administrators have a history of underestimating revenues and overestimating expenses so as to present a bleak financial picture scaring the board and public into either cutting programs, instituting user fees and/or taking the maximum tax increase possible?

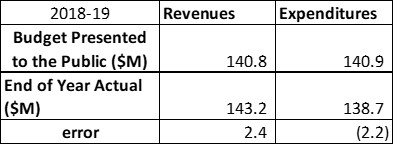

To see if there is any evidence of previous fictitious budgeting we can examine the latest two independent financial audits – 2019-20 and 2018-19. The audit is the only place where the budget numbers used to justify taxation are placed side-by-side with actual year end results. How did the administrators do in 2018-19?

As can be seen from the graphic above, budgeted revenues were underestimated by $2.4M and budgeted expenses were overestimated by $2.2M for an aggregate error of $4.6M. To put the $4.6M error in perspective, that year’s tax increase of 2.4% brought in an extra $2.6M. If the board and public had better budget numbers they could have contemplated a lower tax increase, no tax increase or even a tax decrease.

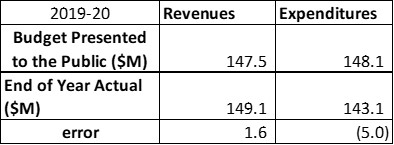

How did the administrators do in 2019-20?

As can be seen from the graphic above, revenues were underestimated by $1.6M and expenses were overestimated by $5.0M for an aggregate error of $6.6M. To put the $6.6M error in perspective, that year’s tax increase of 2.6% brought in an extra $3.0M. If the board and public had better budget numbers they could have, again, contemplated a lower tax increase, no tax increase or even a tax decrease.

What about this year – 2020-21? The fiscal year won’t be done until June 30th and the audit won’t be

available until December. However, the administration has already indicated their budget numbers will have underestimated revenues and overestimated expenses by at least $1.8M.

Bottom line:

- School directors make taxation and program decisions based on revenue and expenditure estimates supplied by the administration.

- The administration has a history of providing inaccurate revenue and expenditure estimates so as to make informed budget decisions impossible.

- The board should ask probing questions to determine whether the revenue and expenditure estimates for the upcoming fiscal year are a true picture of expected results or whether the estimates are “padded”.

- The board should make the public aware of how inaccurate revenue and expenditure estimates can adversely affect taxation and educational program decisions.

Feel free to contact me for further clarification or comments.

A correction –

Pattye gave me an honor that was not deserved. [smile] I was never president of my school board. I don’t have the patience to be one. However, I was chairman of the finance committee for the vast majority of my time on the board. More important, I was an expert witness testifying in Common Pleas Court about Lower Merion’s fictitious budgeting practices that mirror what is happening in TESD. (painting a bleak financial picture at budget time by overestimating expenditures and underestimating revenues so as to scare the board into the maximum tax increase)

I stand corrected, thanks for clarifying Keith!

Thanks for this update Pattye and for providing the email that Mr. Knauss sent to the board. Yes, I too would like to know if any of them bothered to respond to him.

I had watched finance committee meeting live but had not watched all of it (why do these meetings need to go 4 hours!!) Thanks for providing the link.

I went to the specific section of the meeting that you referenced when the board members were commenting about the budget deficit. Although you did not mention the board member by name who made the outrageous remark about the state suggesting that the school board isn’t taxing us enough, residents should know that it was Stacy Stone. I know that you said some of the board members are supporting zero tax increase but it is apparent that Stacy Stone is not one of them! Can you confirm if her term on the board is up this year. Thanks

Thank you for your comment. To answer your questions, Stacy Stone is not up for reelection, she’s has another couple of years remaining in her 4 year term.

I had a response from Rev Dorsey, but no other. Listening to his comments at the recent regular school board meeting I predict a very engaging finance committee meeting on the 7th.

Glad to know that received the courtesy of a response from Scott. Perhaps Scott will share his thoughts here on Community Matters as he has done in the past. The community could really use Scott’s help to “right the ship”!

The comment by a board member about the State saying the district is “not taxing enough” was repeated again at the recent school board meeting. As everyone should expect, the State makes no determination on whether a district is taxing enough and this board member displays a complete misunderstanding of the “market value/personal income aid ratio” that allows poor districts to adjust the Act 1 Index higher. If anything, a rich district like TESD should tax less. Someone should take this school director aside and quietly educate her.

Thank you Keith. I had to replay this sound bite from the finance committee meeting several times — it just didn’t seem possible that a currently serving school board director would make such an outlandish remark. And now you say the same remark was repeated at the regular school board meeting. Just wow. Perhaps Ms. Stone will offer an explanation of her remarks as she has done in the past on Community Matters.

Keith’s numbers clearly show that since 2018 to 2020 no tax increase was justified yet was collected. So those tax increases should be applied to this year’s “alleged” expenditures! To raise taxes every year, as T/E has clearly done, shows that the district’s financial manager’s are failing to live to the district’s annual budget. If you ran a construction company this way it would go bankrupt. Clearly, T/E needs a person at the helm who can live to its annual budget and be held accountable for every overage. Based on 20 years of fixed and variable costs it should not be too difficult to calculate one’s annual budget. Should an “extraordinary” cost be incurred then current funds should be sufficient to cover such costs which can be replenished in the following year with full justification. The District is constantly running on a Time & Material basis to a Fixed Budget. When this occurs it is historically proven that T&M comes in ~20% over the budgeted fixed sum budget.

Your information is totally accurate! But the problem is that the board refuses to see any of the failings of the business manager. Art McDonnell is running the school district and the board allows it.

Hopefully, the PA Auditor General will come in and help educate the district about honest budgeting . The AG chastised the Lower Merion district for repeated fictitious budgeting.

https://www.paauditor.gov/Media/Default/Reports/schLowerMerionSchoolDistrict102617.pdf

Some quotes:

The District Persistently Projected Annual Deficits Despite Realizing Annual Surpluses and Maintaining a Steady $56 Million General Fund Balance

Consistent Over-Budgeting of Expenditures

…the District’s budgets forecasted unassigned fund balances below 8 percent every year. Thus, the District technically complied with the when it approved tax increases. However, over the five-year period, the actual unassigned fund balance as a percentage of total expenditures averaged more than 9.5 percent, which is above the Public School Code threshold of 8 percent.

Keith,

The PA Auditor General doesn’t need to come in and help educate the district about honest budgeting .

Art McDonnell and the Administration and the Board know Art routinely misrepresents expenses and revenues in order to fraudulently raise taxes on taxpayers. They do it because they can. Voters allow it by electing teachers administrators and others who work in education to the school board. Stacy Stone is an ex teacher. Sue Tiede is an ex Administrator. Kyle Boyer is a current teacher. Nothing the Auditor General says to them will sway them to vote in favor of the taxpayer over themselves. They will vote in favor of the highest possible tax increase they can impose every chance they get.

Taxpayers and TE voters,

Would you hire a burglar to guard your house?

We did the same thing when electing Sue Tiede, Stacy Stone and Kyle Boyer to the school board.

The PA Auditor General needs to educate the voting public, not the school board. The school boards knows exactly what they’re doing.

Vote in citizens who have the courage and conviction to stand up to the administration.

Don’t forget Dr. Gusick. Art McDonnell reports to Dr. Gusick, who reports to the Board. Gusick cuts a sympathetic figure for sure, but none of this happens if he says it doesn’t. HE IS THE SUPERINTENDENT. The Board needs to consider the advice Gusick is providing—even if Art is the one to deliver the message.

The goofballs on the board need to start cutting our taxes. They have plenty of money in their CAFR, enough to set up a Tax Retirement Fund to end taxation forever. If we make them.

http://www.cafr1.com/Message.html

Update: The Finance Committee Meeting will now be held in person at TEAO, 7 PM on Monday, June 7. Thank you Doug Anestad for requesting this change and thank you school board for making it happen!

PERPETUAL ‘MO MONEY – RETIREES SINK LOWER

17 YEARS of Increases. As a Retiree I am forced to accept less than the Cost-of-Living (COLA) increase that Social Security has given me for the past many years. I am being priced-out of the market with costs that are above my pay grade.

There should be an EARNED INCOME TAX for those STILL WORKING and receiving a paycheck, for THEY are the receipients of the bonus of sending THEIR kids to our good schools.

Don’t tell me that I benefit by having the schools increase my PROPERTY VALUE! … What good is Land Value if I cannot afford my Monthly mortgage?

I suggest that WORKING PEOPLE with KIDS pay for the brunt of their eductaion and the REWARD “THEY ” receive from this perk. NOT RETIREES!!!

WASOON,

You’re missing the point. No Earned Income Tax needed. No tax increase needed. Look where the money goes. Look at the budget. All tax increases go to outlandish teacher/administrator raises and salaries/benefits healthcare and especially retirement costs that no one working in the private sector gets. If we elect school board directors who understand this, it will go a long way in getting tax increases under control. Another teacher contract is coming up soon. Directors routinely vote to grant teachers raises on their already outlandish salaries, when raises for teachers are already factored in their contracts. See the step schedule matrix.

Wasoon,

I can appreciate the fact that you have lived in TE; you & your kids helped contribute towards making it a great school district along with our great teachers.

However, the current parents are ensuring that the high standards are continuing. After all, it’s our kids who are now taking the standardized tests, involved in activities-sports, music, clubs etc and making the high grades to ensure the legacy continues. You see, if you remove our motivated kids, you just have empty school buildings which will not help increase the value of your home.

Unfortunately, we have some TESB members who fail to recognize this simple truth. Tax & spend is the only way they know how to manage a school district. And as Anon states, No Earned Income Tax is warranted.

2 thoughts:

First, it does not surprise me that there would be a huge variance in 2020/2019 but my question is what is the policy regarding the extra revenue? Why wouldn’t we start the following year down by the overage? $5 million is significant. If there are extra costs in bringing a bunch of traumatized kids back in, then be transparent about that.

Second, from what we have seen in the last year from the Easttown planning board, there is none. There has been no analysis used to determine how many kids are coming from apartment buildings and they moved to approve another 100+ unit building on route 30 this week with no analysis done. They tout some sort of vague revenue benefits to the businesses in town but we pay otherwise with a flood of unfunded students in the schools. There has to be some sort of connectedness between planning in the townships and the schools. Or I suspect we will see the tax increases of the last few years look quaint in comparison to what’s ahead of us.

Easttown is glad for any added revenue that comes from the new apartment complex….as long as it’s built only along the fringe of the township’s border. Any other complication resulting, particularly along route 30, tends not to be its responsibility. And regarding school population, since the majority of elementary schools, all the middle schools and the high school are located in Tredyffrin, Easttown does not bear the majority of added traffic, buses and annoyance to its general citizenry. “Keep them out of our area and make use of our neighbors.”

With all due respect, this is complete nonsense. The approved building dumps hundreds of cars along the intersection of route 30 and the Berwyn neighborhood where kids are picked up and dropped off six times a day. Both the high school and TE middle school are within or adjacent to Easttown and already struggle with traffic. We need responsible development. Investors are not entitled to profiteer off our township. There has been no evidence to date that the township will benefit at all from revenues generated from this project, nor has it been a consideration in the so-called planning process.

So COVID strikes and everything is shut down. How much money from the budget was saved and became a surplus? Not spent on transportation, electric, gas, overtime and other incidental expenses? Where is that surplus? Was the surplus just “used” up so as to raise the budget? We all know how most budgets work. If you don’t spend it, you don’t get it back next year. Did someone give the order to spend it and if so who and what or how was that money used?

How were other school districts able to have a surplus and reduce or not raise taxes? Do they have a more competent business/finance manager? Has anyone questioned him hard on expenses?

Raises? Some if not a vast majority of us took pay cuts and continue to receive pay cuts. Maybe the administrators could take a cut. Maybe if they resided within the school district, paid the ever escalating taxes, things would be different.

Questions questions

Responsible Parent is right:

“There has to be some sort of connectedness between planning in the townships and the schools.” YES!

Tredyffrin is just about to adopt a new Comprehensive Plan with Land Use Recommendations that tilt towards increased density and wishful thinking about the likely occupants:

7.3 Support a variety of housing choices in the developable areas of the Township.

Actions: Ensure that zoning regulations allow and encourage a variety of residential units to meet the needs of aging residents and to appeal to younger generations with diverse housing preferences. Consideration should be given to providing for more “missing middle” housing choices such as such as duplexes, fourplexes, cottage courts, and multiplexes.

7.4 Consider modifications to current zoning …..

….Allowing for more residential uses in more zoning districts …..

Actions: Update regulations for the commercial zoning districts to integrate by-right uses that provide a more diverse mixture to promote more of a “work, live, play” environment. Further consideration can be given to updating regulations in office and limited industrial zoning districts to integrate more housing options….

Residents should read the Comprehensive Plan https://www.tredyffrin.org/home/showpublisheddocument/13320/637545026704270000

and let the Township know how they feel about it.

In addition, of course, to calling out the School Board for its record of budgeting failures and for the absence of any detailed comparisons of current year projected actuals to wished-for budget projections on which to base any analysis and final approvals.

Thank you, Pattye, for your continuous advocacy on our school and community matters. I believe as TE residents, it is critical that we are informed of how does our school district manage our tax dollars. Education should be the #1 priority for our school district to fund, which includes funding of academic focused programs, retaining our best teachers, and supporting our students clubs for extracurricular activities. What made TE schools at the top of the ranking is not because of the continuous tax increase that can fund the schools better, it is because of our wonderful parents that willing to support their kids to achieve their academic excellence in every way they can. So using a fictitious budget to justify an unnecessary tax increase is only to create the fear of cutting any educational program. I wish our board member will be honest to us and knowing that the responsibility of any board member is to representing their constituents. I wish the discussion of how the final budget was formulated will take place at the next Finance Committee meeting.

And as a reminder — the next Finance Committee meeting is this Monday, June 7, 7 PM — in person at TEAO! Residents, please come to the meeting and participate in the discussion.

Thank You Responsible Parent & Mr Clarke

The residents of this township need to educate themselves and connect the dots. As the Comprehensive Plan reveals, the people in power of our township are not looking out for the current residents. Their plans to expand, an already fully developed township, is proof. The Plan will explode the ever increasing school population and over crowd our schools. It will require increasing the need for ambulance service–which is already over used due to the “planning” commissions’ approval for any open land as a nursing home. Both of these examples will require large tax increases for the current residents. But why?

Take a look at the planning commission.

Take a look at the school board.

Take a look at the board of supervisors.

They all have one thing in common….

Saul Ewing law firm. It is a real estate law firm.

Doesn’t matter if Dem, Rep. or Independent. They are in bed with each other, representing themselves–from our perspective.

Take a look at the head of the supervisors. He worked for Saul Ewing for over 20 years. Who do you think he’s loyal to? It’s like the Tom Cruise movie, The Firm.

The voters/tax payers of this township need to wake up and realize the nice people who are in power are nice for a reason. So they lull you into believing everything is just fine.

Read the Comprehensive Plan, (watch The Firm)—-things are not fine.

Where can we get a breakdown of “other expenditures”? Is there any place that the SB is presenting that breaks down the cost for hiring the Pacific education group on training our teachers on “critical race theory”? Let’s face it the TESD is changing what our kids are being taught as well so there must be a cost involved with that.

Also, how much is it going to cost for a specific virtual learning initiative ? What goes into the other category ?

COVID guidelines are harming our children

Transmission of COVID-19 among children in schools and daycares is very rare. In fact, according to published data by the CDC, 99.99815% of children who contract COVID-19 survive. Despite this, the CDC issued COVID guidance calling for a host of extreme mitigation measures that are harmful to schoolchildren and counterintuitive to learning. Since returning for in-person learning, children across the United States have been subjected to forced masking, being physically distanced from other students, plexiglass barriers, scheduled bathroom breaks, closed lunchrooms and playgrounds, daily temperature checks, routine PCR testing, contract tracing, repeated quarantines and more.

These measures are harmful and unnecessary. As such, we’re asking governors and departments of education to follow the lead of Florida, Texas, Iowa and other states and permanently lift COVID-19 guidelines in our schools. Schools should create school policies —not government bureaucrats with significant conflicts of interest who are completely disconnected from the children they’re making policies for.

The “we will just follow” philosophy is not working

In a time fraught with fear and paranoia, elected officials and school districts have been making decisions without basing those decisions on solid scientific data. Proclamations like, “We will just follow the CDC,” or “We will just follow the governor,” or “We will just follow the health department” have become commonplace.

However, when you peek behind the curtain, the CDC and health departments are not doing the critical risk analysis needed to make appropriate recommendations for our children. That’s why it’s essential for each person to be the ultimate authority on what’s best for their health and their children’s health. In no way should the CDC have the final say on how we care for our bodies or what interventions we adhere to. And, when it comes to kids, parents are always best suited to make decisions for their children — and it’s the school’s job to support those decisions.

CDC K-12 COVID Prevention Strategies |

The CDC says its guidelines are the best way to keep schools safe and keep them open. Many experts disagree.

We are living in a time of great confusion and uncertainty. With this, many are questioning what parents want, what government expects, what is best for kids, and what is doing more harm than good. We all have reason to be confused, particularly in light of the ever-changing and contradictory guidance that is peddled to us as “law.”

Where’s the beef?

Health guidelines should unequivocally be evidence-based. Yet looking at the pre-COVID science and existing COVID “science,” it’s abundantly clear that the CDC’s guidelines are anything but evidence-based. Guidelines are not science-based when they suddenly change based on millions spent on lobbying by pharmaceutical companies or a powerful teacher’s union. We should be making policy decisions that are grounded in evidence-based practices, and we should be looking at those policies in terms of the real-world consequences they have on the people they affect. Yet somehow, even with strong evidence that school COVID guidelines are harmful, the CDC is still dictating how we operate our schools and care for our kids.

We must ask ourselves what changed between the time the World Health Organization (WHO) stated,

“The widespread use of masks by healthy people in the community setting is not yet supported by high quality or direct scientific evidence and there are potential benefits and harms to consider…”

and the CDC recommendation for the entire population, starting at age two, to wear a face mask. Even the WHO states that masks worn imperfectly are dangerous. We have to ask ourselves … what about the kids?

It’s time to put kids first

For the last 15-plus months, we have waited — some of us more patiently than others — for the COVID responses to play out. We have now waited long enough. It is time, as a global community, to reflect and make choices that are best for our children — a vulnerable population that’s disproportionately being affected by unnecessary COVID-19 protocols.

“Nothing is more important than facial expressions in how people relate to each other.” Peter Breggin, M.D., world-renowned psychiatrist and medical ethicist

Some children we spoke with report being repeatedly sent home throughout the year because of contract tracing in the schools. Yet most of our schools are “just following orders” and thus, have created an environment of isolation for our children by sending them home to be in isolation for two weeks at a time. Since when do we employ preventative measures on our children that cripple their development? It’s not just the masks — it’s the physical distancing of school desks and people from each other, the quarantines from contact tracing, the constant sanitization measures, the plexiglass barriers, and the faceless environment that perpetuate constant fear. All of it is isolating and harmful!

School isolation is akin to prison isolation

Research shows that isolation within the prison environment can be as distressing as physical torture. Yet we wonder why we are witnessing record levels of behavioral regression, new behavioral issues, anxiety and depression when our children are under protocols that are extremely isolating and that create major barriers to connection in the classroom. We’re then removing that connection altogether when a student is sent home for weeks at a time due to contact tracing. Some of these children are being locked in rooms, away from the rest of their family members, to keep everyone “safe”— even though they’re not sick!

Masking and social isolation have caused unprecedented mental, emotional, and psychological harm to our nation’s children. Suicides among children are at an all-time high.

Children are not at risk

As of April 22, 2021, children (aged 0-20 years) comprised 0.00%-0.19% of all COVID-19 deaths in the United States, while 10 states reported zero child deaths from the virus. Coronavirus does not affect children like a typical virus does; clearly, children account for an extremely low percentage of cases and have a 99. 99.% recovery rate. So why are we submitting them to these untested and harmful school guidelines?

The premise that children can be an “unknown risk” to others rests on an illusive and unproven idea of asymptomatic transmission that’s been the basis for all COVID protocols. However, peer-reviewed research paints an entirely different picture. In a study of 10 million people in Wuhan, 0% of transmission was shown to be asymptomatic! These findings are also confirmed in a study in the Journal of Pediatrics.

There are other (and better) paths forward

Centner Academy is a case study in the heart of Miami, Florida, for what it looks like to maintain a learning environment that is optimal for children while being as normal as possible. With about 300 students from pre-K through grade 8, the school has had no forced masking, no physical distancing, no contact tracing, no parental exclusion, and no plexiglass barriers. The result? The school has had zero hospitalizations among students, teachers and staff.

Dubbed the happiness school, Centner Academy is an excellent observational example that should inspire people to breathe easy, abandon the mass fear and hysteria, and take heart that our kids — and those in our schools who are there to support them— can indeed flourish.

“Parents are not realizing the magnitude of the damage that’s being done to their children,” remarked Centner Academy CEO and co-founder Leila Center. “It’s profound, and its going to be harder and harder to reverse the more they keep their children in these schools with these ridiculously strict COVID measures that have nothing to do with the children.”

Ms. Centner encourages others to take her school’s lead of a heart-centered, children-centric approach approach. “Children don’t have a voice; we are their voice. So I need and I want parents to fight back to save our children.”

Centner Academy COVID Stats |

Centner Academy, a school with about 300 children in the heart of Miami, has not followed the CDC’s COVID-19 guidance. Despite this, zero children, teachers or staff members have been hospitalized.

The CDC’s guidelines are suggestions — not law

States and health departments do not have to blindly follow CDC guidelines. They are, after all, only recommendations. Likewise, instead of blindly following their local health departments’ recommendations, school districts have a fiduciary duty to ensure that all children in their schools are properly educated and cared for. The CDC’s recommendations must not be accepted as gospel, especially in light of nonsensical measures like forcing kids at summer camp to stay masked outdoors during all types of activity except when the kids are eating, drinking and swimming. Studies suggest the risk of contracting COVID-19 outdoors is 0.1% or lower.

Take a stand now: get our schools back to normal

Never before has it been so critical to stand up for the rights of our children! Mandatory, experimental interventions such as forced masking, forced social distancing, constant hand sanitization and keeping children in contained spaces have been shown to cause serious physical, emotional and socially developmental damage. Schools with these measures are not suitable environments for children, and we don’t know what damage these measures will cause to them over the long term; they’ve never been studied. However, we do know that COVID measures have led to a severe uptick in depression, anxiety and other mental disturbances. In fact, the rate of suicide in the pediatric population is at an alarming, all-time high.

By adopting the “we’re just following orders” mentality, government officials, school administrators and many educators have created an atmosphere that is not safe for school children. Their draconian measures have fostered an atmosphere where children have become afraid of themselves, other humans and their innate environment; sadly, many are now convinced that the world is a scary place. Countless parents have expressed concerns that our current policies are seriously harming children and interfering with their normal childhood development. But things remain unchanged.

It’s time to stand together and fight for our nation’s most valuable asset — our children.

CORRECTION—

TE Planning Commission is NOT affiliated with Saul Ewing, the real estate law firm. The Chair has his own real estate law firm, representing real estate developers & builders.

Is that a conflict of interest?

If TE School Board can have ex-administrators & teachers, then the planning commission can have a law firm representing real estate developers & builders?

Welcome to the new TE & one party rule, where the politicians represent themselves, their special interests and not the community.

Why are our students still required to wear masks at TESD?

All the teachers & Administrators are vaccinated.

Where’s the science requiring them to wear masks?

To provide an update on the Finance Committee Meeting tonight (June 7th): 2.7% tax increase rate will be recommended to the general school board meeting next week for the final vote. No direct answer was given to the discrepancies presented in the past 3 years between the budget and the actual. Board member still kept emphasizing on how much increase there was for the Special Education and PSERS expenditures that demand more tax payment to support the increasing expenses, but completely ignored the real question was not about those increases, it was all about the accuracy of the budget which was used to justify the tax increase. Also, in this meeting committee passed their recommendation of a new money bond of $31M funding scenario and the adoption of the reimbursement resolution. I’m sure the other TE residents attended this meeting may have more details to share.

Thanks for attending the Finance Committee and providing an update Deanna.

I had really wanted to believe that the discussion over the last months in the finance committee meeting and budget workshop of a zero percent tax increase was sincere. Sadly, it looks like that was not the case.

I am curious to know where each of the board members in attendance at the meeting was leaning regarding the tax increase. The finance committee chair Roberta Hotinski was the one front and center touting the 0% increase for months, is she now in the camp of tax increase? If so, an interesting flip-flop Dr. Hotinski or maybe you were never serious about a 0 tax increase to begin with!

Is Scott Dorsey the only school board director holding to no increase? And remember folks, Rev. Dorsey is off the board at the end of the year — who will have the backs of the taxpayers then?

All residents need to pay attention … next Monday, June 14 at the regular school board meeting (in person) the vote is taken on 2021-22 budget. It certainly looks like the date will mark the 17TH STRAIGHT YEAR of a tax increase. Impressive record to hold TE School Board!!

A couple of brief comments from an attendee at the Finance Committee meeting:

Only Scott made any comments favoring a zero tax increase. He likened the School Board history of constant tax increases to a drug addiction. I could not agree more! It’s time for the Board to go into rehab, restrict the money supply and force the Administration to take seriously the idea mentioned by Dr. Gusick for a fundamental long term revamping of district processes. If that’s going to take a couple of years to implement, then use Fund Balance and federal payments (completely un-recognized in the budget) to fill the gap.

If there’s one way to guarantee the need for a new elementary school it is to keep ratcheting up taxes, forcing out commercial owners and fixed income residents, to be replaced by “mixed-use” high density residential housing and families just here for the schools.

The bond issue discussion was interesting. We were regaled with charts showing how 10 year muni money is at historic lows of ~1% (we’ve seen those charts before, at higher rates!), just before being shown a repayment schedule where 60% of the money was 20 year or more. When asked for the APR, the financial advisors mumbled about 3-3.5%, but audience math has a much higher percentage (calculate $52 million to repay $31 million over 24 years – you wouldn’t want a mortgage like that). The District has got itself into a real problem with bond repayments that are so back-loaded.

The Board did their absolute best to pass on all responsibility to Harrisburg – everything from Act 1 to Special Ed to transportation. There was an extensive dissertation from Dem operative Hans von Mol about HB272 – a bi-partisan attempt to apply standards to, and control the costs of, charter schools. A worthy idea for which residents should show their support (write your legislators!).

Of course, we were given no detailed projection of the 20/21 Actuals and comparison with the 21/22 Budget. It’s three weeks from the end of the year and if history is any guide, the high level numbers the Board is supposed to work with will be off by millions! Supposedly the information assumptions provided back in the early days of budget development are all that’s needed for a decision now.

From my notes, the Board will be presented with three options for property taxes: 0%, 2.7% and a “break-even” percentage that likely will include other expenses and revenues tweaked to lower the “gap”. My guess for that is 2.25%.

Residents might consider skipping next week’s School Board meeting and instead putting on their calendar the June 23rd 7pm public meeting of the Tredyffrin Stormwater Task Force at the Township building. Perhaps public input can encourage one of our municipalities to apply resources to resident priorities.

Thanks for attending the finance committee meeting Ray — and thanks for providing your comments. So — the choice is 0%, 2.7% or a break-even tax increase. As forecasted, only Rev. Dorsey is looking out for the impact of the annual tax increase by the school board on its residents. Any talk about ZERO tax increase is simply hyperbole! All that’s left is the official vote and we’ve got 17 straight years of tax increases!

But I will respectfully disagree my friend about your suggestion that residents “skip” next week’s school board meeting. We need to go and make our opinions known, if only to bear witness to the fact that the school board DOESN’T CARE what we have to say!

A few notes about charter schools — the district has not reached out to families that left for charters to ask why they left or what they would need to return. They also haven’t been asked to return or asked if they are returning. Speaking for my family and for the other charter families I know — representing 20-30 kids.

Some charter funding reform is need, especially around reimbursement formulas for special need kids. But proposed cuts that would immediately chop off 30 – 50% of the funding per kid would kill school choice as it would kill the charters. How would TE function if all of a sudden the money they got per child dropped that much?

Maybe have conversations with families so people don’t choose to leave or are inspired to return. We should mean more to the district than as a budget line fall guy for a budget shortfall and excuse for a tax increase.