The saga continues … Sexting offenses, alleged hazing and residency dispute all involving one TE School District family. Chester County court rules against the TE School District in a stunning decision by Court of Common Pleas Judge Jeffrey Sommer regarding residency.

The saga continues … Sexting offenses, alleged hazing and residency dispute all involving one TE School District family. Chester County court rules against the TE School District in a stunning decision by Court of Common Pleas Judge Jeffrey Sommer regarding residency.

(The complete article from today’s Main Line Media News follows my comments).

After reading the article, the first word that comes to mind is “accountability”. Under whose authority did this situation happen — the hiring of the private investigator (from Cloud Feehery & Richter) at tax payer expense ($12K +) over a specific residency issue? Does the District pay the private investigator over each claim of non-residency or was it just trying to get this specific student out of the District after sexting offenses? Who made this decision? Was it at the direction of the TE School Board and/or Superintendent? Is the hiring of investigators in residency situations routine in the District? Does the School Board approve the residency investigations or is decision up to the school administration?

In rendering his decision in this residency case, Judge Sommer stated, “We find that the hearing officer willfully and deliberately disregarded competent portions of (the father’s) testimony and relevant evidence which one of ordinary intelligence could not possibly have avoided in reaching a result, thus making his credibility determination arbitrary and capricious,” The judge also determined that the alleged victim and his father were denied their right to counsel.

The ruling of Judge Sommer certainly points to incompetence of the private investigator and the TE School District. The judge calls the District’s investigator incompetent and the taxpayers are stuck with the bill. School Board, where are you? Were you aware of this specific investigation regarding the residency of the alleged hazing victim and the apparent mishandling of the process? Was this a way to get the student out of the District? And how does the District Solicitor Ken Roos factor into the residency investigation — was the decision to engage a private investigator in this specific case at his recommendation/advisement?

Who is in charge, where’s the oversight and accountability? I note that the District declined to comment for the article, what about the School Board? Will we receive an explanation?

by Adam Farence

Court of Common Pleas Judge Jeffrey R. Sommer ruled in favor of the alleged hazing victim with regard to his residency issue with the Tredyffrin/Easttown School District, reversing the school board’s original decision to stop funding the alleged victim’s education at Buxmont Academy. Sommer also ruled the victim does not owe over $13,000 to the school district.

According to court documents, Sommer drew his conclusion from two issues. First, he determined the hearing officer from an earlier meeting incorrectly concluded the alleged hazing victim did not meet the federal definition of homeless.

The victim was reportedly kicked out of his previous Devon residence by his great-grandmother after his arrest for sexting-related offenses in October 2015. After he was kicked out, the alleged victim’s father drove him back and forth between his Devon bus stop and his mother’s residence in Chester, Delaware County.

It was during this time period that T/E officials hired a private investigator from Cloud Feehery & Richter to determine if the alleged victim did actually live within the school district boundaries. After several months of surveillance, the private investigator determined the victim did not live there.

The school district spent $12,281.92 on services rendered by Cloud, Feehery & Richter, according to a Right-to-Know request filed by the Daily Local News.

The alleged victim could not claim the Chester residence as his, according to court documents, essentially depriving him the chance to pursue a free education in Delaware County, and Sommer determined the alleged victim met the federal definition of homeless. He also criticized the hearing officer’s original finding.

“We find that the hearing officer willfully and deliberately disregarded competent portions of (the father’s) testimony and relevant evidence which one of ordinary intelligence could not possibly have avoided in reaching a result, thus making his credibility determination arbitrary and capricious,” Sommer wrote.

Sommer also pointed out the hearing officer was employed by the school district. “It takes no great leap of faith to recognize that the hearing officer is being paid by TESD, their ‘adversary,”” he wrote.

Second, Sommer determined the alleged victim and his father were denied their right to counsel.

According to court documents, the victim’s father was notified of the Jan. 20 non-residency hearing with the hearing officer only a few days prior. Sommer also wrote that the school district did not notify the father’s attorney even though they had been told in writing to do so.

Originally, the family was represented by William McLaughlin Jr., before he passed away in late March. For the remainder of the case, the family was represented by a new lawyer, Robert DiOrio. “…TESD not only did not notify Attorney McLaughlin of this hearing but made the pre-hearing notice period so short as to effectively cut Attorney McLaughlin out of the process,” court records state.

At the Jan. 20 non-residency hearing, the victim’s father did say he chose to come without counsel and knew he had the right to proceed with counsel if he wanted, but according to court documents, the circumstances surrounding the hearing undermined due process.

“We are very pleased with Judge Sommer’s well-reasoned decision,” wrote DiOrio.

School district officials declined to comment.

“We do not discuss individual student matters and therefore do not intend to comment on this specific case,” wrote district Solicitor Ken Roos. “However, the district remains committed to enforcing its policy of only permitting district residents, including anyone properly qualifying as homeless, to attend district schools.”

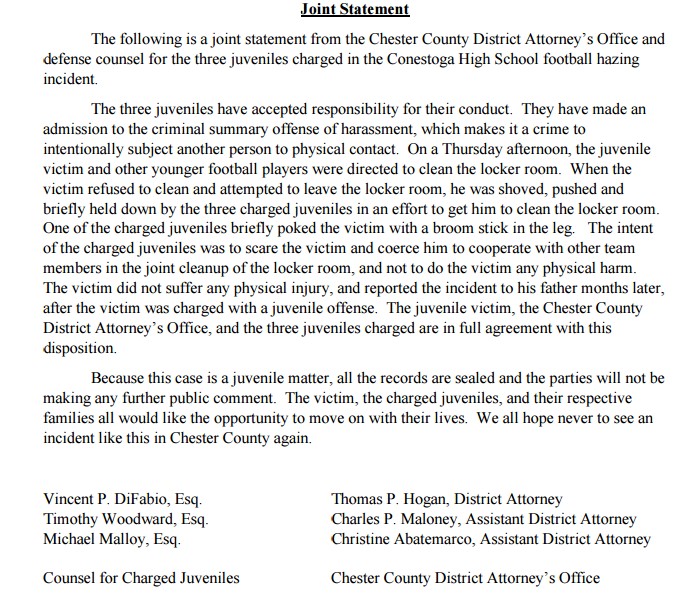

The alleged hazing victim’s father received a bill late January for over $13,000, after the school district originally determined he and his son reportedly lived outside the district’s boundaries. The father reported the alleged sodomy to school district officials about a week later in early February, and Chester County District Attorney Tom Hogan announced assault related charges against three Conestoga High School football players on March 4. Over the course of a few days, news of the charges and the alleged sodomy spread across the nation.

Fourteen months ago in March 2016, the TE School District fired five Conestoga High School football coaches and head coach John Vogan resigned after Chester County DA Tom Hogan charged three football players with sexual assault of a younger player. The investigation stemmed from a freshman football player’s allegations that three senior players held him down and penetrated his rectum with a broom handle in October.

Fourteen months ago in March 2016, the TE School District fired five Conestoga High School football coaches and head coach John Vogan resigned after Chester County DA Tom Hogan charged three football players with sexual assault of a younger player. The investigation stemmed from a freshman football player’s allegations that three senior players held him down and penetrated his rectum with a broom handle in October. Yesterday was a big win for taxpayers in the Lower Merion School District.

Yesterday was a big win for taxpayers in the Lower Merion School District.

A significant decision in the

A significant decision in the