On Monday, June 14, 7:30 PM at Conestoga High School, the TE School Board will hold its first in-person regular board meeting in over a year. (Click here for the agenda). The lengthy agenda (400+ pages!) for the meeting includes the discussion and adoption of the 2021-22 final budget and virtual programming. Will the school board break the cycle of annual tax increases?

Regarding virtual programming, the school board will discuss and vote on the District’s recommendation as follows:

1. To decline K-8 virtual pilot for 2021-22 (based on insufficient enrollment commitment) and consider possibility of offering in future year and

2. To pilot on Personal Finance Course at CHS in a combination virtual format for the 2021-22 school year.

For many TESD residents, the focus on Monday will be on the school board and the vote on the 2021-22 final budget. Included in the agenda information are three budget options – 0% tax increase, 2.5% tax increase and 2.7% tax increase. Given the school board discussion at the last finance committee meeting, the fact that a zero percent tax increase is included as a budget option is remarkable. All school board members attended the finance meeting and as far as I could tell there was only one school board member (out of nine) advocating for 0% tax increase – and that was Rev. Scott Dorsey.

For months, some on the school board would have us believe that a zero-tax increase was an actual possibility, but is it really? At one of the finance or budget workshop meetings at least one school board director suggested that a zero percent tax increase was disingenuous. (I took the remark to mean there would be a tax increase included for the 2021-22 budget). And at several meetings, another school board member repeatedly suggested that Harrisburg didn’t think that we (the TE taxpayers) were taxed enough, although there was no evidence presented to back up the remark.

For those that have only recently moved to the TE School District, you may think that a 2.5 or 2.7 percent tax increase is no big deal; particularly if your move here is based on a perceived quality of the education. On the surface, I would probably agree but the problem is that a tax increase is an annual event in T/E. If the approval of the final 2021-22 budget includes any tax increase – it will mark the 17th straight year of tax increases.

But it’s more than an annual tax increase that is troubling — questions continue to swirl regarding fictitious budgeting (underestimating revenues and overestimating expenses). Although residents regularly comment and ask specific questions regarding the District finances, there is little response from the school board. Clearly the answer should not be to simply follow the business manager, wherever he leads!

Critical Race Theory … Is the District teaching?

In addition to the scheduled agenda items, it is anticipated that parents will have questions for the board and administration regarding “critical race theory” (or CRT). There is confusion (or at least I should say that I am confused) about whether the school district is teaching critical race theory in the classrooms.

Critical race theory isn’t a simple – or single – idea. So … does the District teach CRT? There are those parents who claim that TESD teaches CRT and that it should continue. Conversely there are parents who do not support CRT in the classroom (and say that it is taught). And then there are those (including at least one school board member) who says that the District does not teach CRT. This should not be so difficult — does TE School District teach critical race theory?

The District has a contract with Pacific Educational Group (PEG), national consulting firm which provides racial equity training. Does this group provide CRT curriculum information/suggestions to the District?

I don’t have the answers, but parents should have no confusion on whether CRT is taught in TESD. According to District Policy 6132, “Parents have the right to inspect any instructional material in the child’s curriculum …” and “Parents have the right to inspect any instructional material in the child’s curriculum.” If followed, the policy takes away the confusion and parents can easily know what their children are taught. So other than the question about whether the District teaches CRT, is Policy 6132 followed?

This week, three Change.org petitions related to critical race theory and the TE School District began to circulate around the community. The below links include the originator or group name, petition title and current number of signatures. To understand the position of those behind the individual petitions, click on the links. Review the petitions and read the comments.

Start Date: June 7, 2021

Originator: Concerned Parents

Title: Families Stop Critical Race Theory in the Tredyffrin Easttown School District

Current Number of Signatures: 493

https://www.change.org/p/families-stop-critical-race-theory-in-the-tredyffrin-easttown-school-district

Start Date: June 9, 2021

Originator: TESD Resident Anita Friday

Title: Support Critical Race Theory in the Tredyffrin Easttown School District

Current Number of Signatures: 123

https://www.change.org/p/change-org-support-critical-race-theory-in-the-tredyffrin-easttown-school-district

Start Date: June 10, 2091

Originator: United TE Parents & Community

Title: Uniting Tredyffrin-Easttown for Accuracy, Equity, & Respect

Current Number of Signatures: 264

https://www.change.org/p/the-entire-tredyffrin-easttown-community-uniting-tredyffrin-easttown-for-accuracy-equity-respect

Bottom line, whether it is the budget, yearly tax increases or critical race theory, the school board meeting on Monday, June 14 (7:30 PM, Conestoga High School) is important … please make the effort to attend.

Our collective voices need to matter more!

Between the raging pandemic and the horror witnessed in our nation’s capital last week, focus on other matters is hard to come by these days.

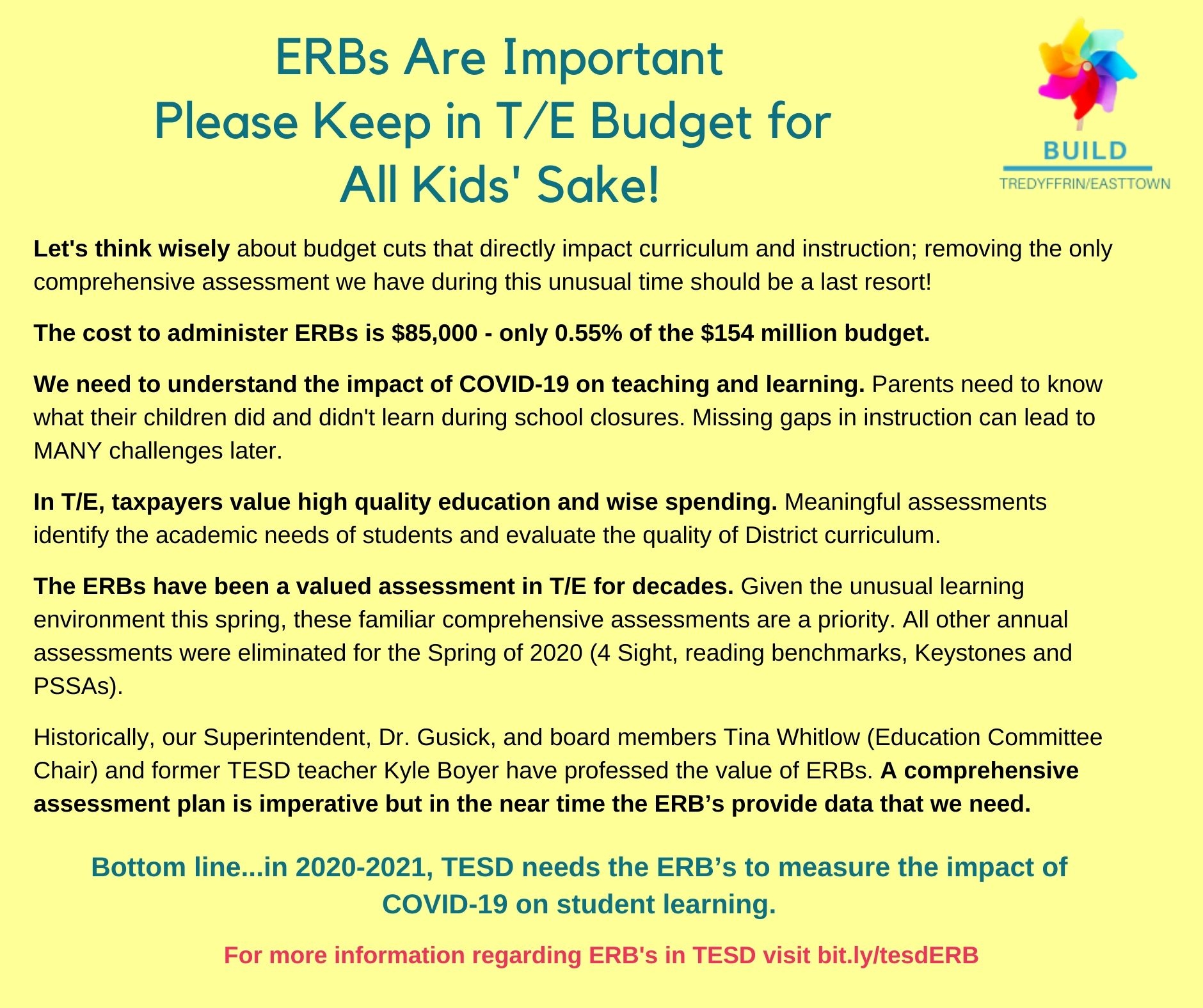

Between the raging pandemic and the horror witnessed in our nation’s capital last week, focus on other matters is hard to come by these days. T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website,

T/E School Board votes on the 2020-21 final budget on Monday, June 8, 7:30 PM. Due to Covid-19, the meeting is held virtually — to access the meeting visit the T/E School District website,

Watching the virtual school board meeting for nearly three hours last night was not for the faint of heart. A few of my takeaways —

Watching the virtual school board meeting for nearly three hours last night was not for the faint of heart. A few of my takeaways —