The Bishop Tube Co., a former steel tubing plant which produced stainless steel tubes from the 1950s until 1999 consists of 13 acres and is located off Malin Road, south of Route 30 in Malvern, East Whiteland Township. The property is a highly contaminated site with Pennsylvania’s Department of Environmental Protection (DEP) accused of neglecting the problem for decades. For DEP history and recent updates on Bishop Tube, click here.

Photo by Carla Zambelli

Former owners of the site did not remove contaminants, including a carcinogen (trichloroethylene, or TCE) that was used as a degreaser. TCE has been linked to cancer and was found in the property’s soil, groundwater and Little Valley Creek which borders the Bishop Tube property. Located directly east of the property is the General Warren Village where residents suspect that the toxic substances have spread into their community, causing cancer and other illnesses.

Developer Brian O’Neill purchased the Bishop Tube property to build 228 houses on the contaminated site with cleanup required. Some neighbors fear that the planned cleanup would further expose them to the contaminants. From the start the redevelopment project has been plagued with problems — accusations of impropriety, innuendos of preferential treatment, legal battles from multiple sides and more players than one can count.

My friend and fellow blogger, Carla Zambelli has closely followed O’Neill’s proposed townhouse project at Bishop Tube site; keeping us informed on Chester County Ramblings. I suggest visiting the blog, and entering Bishop Tube in the ‘search’ on the homepage for multiple articles.

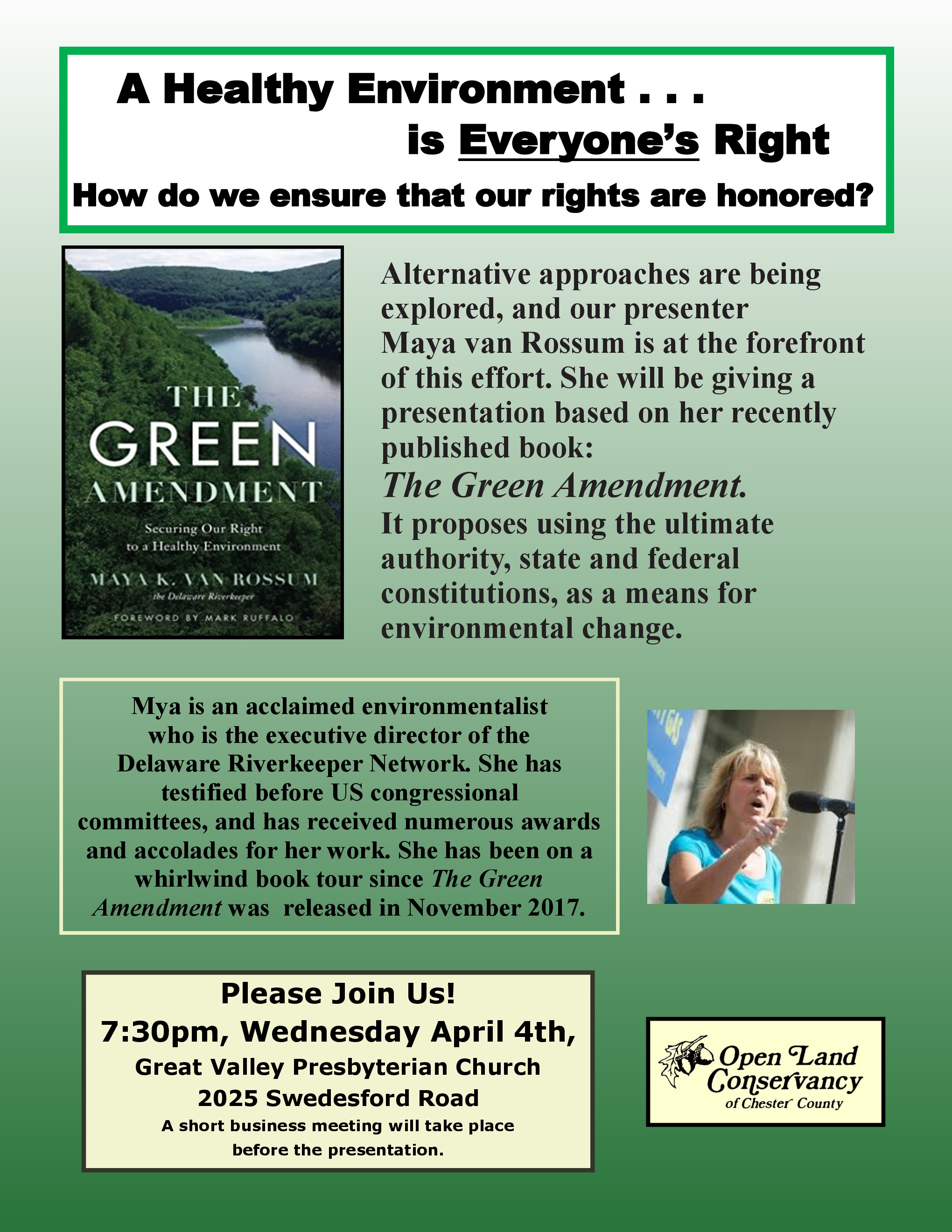

A very loud voice demanding cleanup for the highly toxic industrial site comes from Delaware Riverkeeper Network (DRN), and environmental group and its leader for twenty-three years, Maya van Rossum. In an attempt to silence and seek damages, O’Neill filed a $50,000 SLAPP lawsuit against van Rossum and DRN. Chester County Court of Common Appeals dismissed the lawsuit, however the case remains active in the Superior Court.

The Delaware Riverkeeper Network works throughout the four states of the Delaware River watershed (NY, NJ, PA & DE) and at the national level using advocacy, science and litigation.

On Wednesday, April 4, 7:30 PM at Great Valley Presbyterian Church, van Rossum will be the guest speaker for the annual meeting of Open Land Conservancy of Chester County – the public is invited. (See flyer below).

Please spread the word on this meeting — For locals, it will be a great opportunity for a firsthand update on the contaminated Bishop Tube site from someone on the front lines!