A bit of background —

On February 4, I received a copy of a memo dated January 31, 2014 from Sue Tiede, Director of TESD Personnel. Tiede’s letter went to ‘All Employees paid on an Hourly Basis’ (aides/paras) with the subject line, ‘Attendance & Punctuality’. Although I was told that ‘all aides and paras’ received the letter, that was not accurate – some of the aides and paras did not receive the letter until this week, 10+ days later. On Wednesday, February 12, aides and paras across the District were called individually into the principal offices of their respective schools to read Tiede’s letter. Before discussing the contents of Tiede’s letter, I have a problem with lack of District cohesive communication.

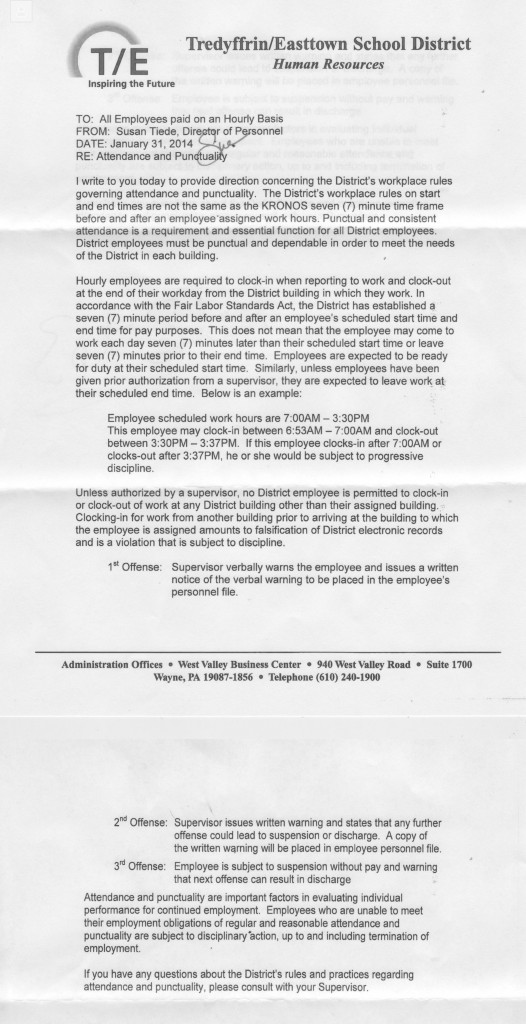

Memo to T/E aides and paras –

The focus of Tiede’s memo is the District’s establishment of a 7-minute period of clocking-in and clocking-out for hourly employees. These employees are only permitted to clock-in within a 7-minute period before their scheduled start time and within a 7-minute period after your scheduled end time. If scheduled to start work at 7AM, employees can only clock-in between 6:53AM – 7AM. If scheduled to end your workday at 3:30PM, employees can only clock-out between 3:30PM-3:37PM.

Having set the guidelines for the 7-minute clock-in and clock-out period in her memo, Tiede then details the progressive discipline measures for violation. A three level discipline approach, aides and paras receive a verbal warning and written notice for their first offense. An employee receiving a second violation receives a written warning in theur personnel file with threat of suspension or discharge if another violation occurs. If an employees is cited for a third violation of the 7-minute rule, they are subject to suspension without pay and possible termination.

I find the contents and tone of Tiede’s letter demeaning and threatening to the District hourly employees. District aides, paras and substitute teachers currently do not have District provided health coverage. TESD aides, paras and substitute teachers do not have the benefit of organized union protection as do other District employees — the teachers (TEEA) and members of TENIG.

What is driving this letter of intimidation from the District? In my opinion, the answer is Affordable Care Act and a way for the administration to make certain that hourly employees not go over the 30-hour limit that requires employee covered health coverage. By instituting this policy of progressive discipline, the District is not considering the safety of flight risk children and special needs children. Did the District explain this new 7-minute policy to the parents of these children? There will be situations occur where aides and paras are required to choose between remaining with a child or risking disciplinary action by not clocking-out within the 7-minute window. The use of time clocks for our District educators is nothing more than a different category of factory worker.

Was this 7-minute District policy and corresponding disciplinary action vetted by the School Board members? Was their discussion about the ramifications of this policy for special education students and their parents? Is this just another approach by the District to outsource the aides and paras – meaning, intimidate and threatened these employees to the point that they just leave.

Last spring, we saw the backlash from the public over the School Board’s attempt to outsource the aides and paras rather than comply with the Affordable Care Act — is this letter to District’s hourly workers, and its contents, a precursor to round two this spring? As previously mentioned on Community Matters, the School Board has repeatedly delayed any further public discussion of the ACA compliance issues — meeting after meeting. Perhaps part of the back-story to the Board’s continuing resistance to discuss the associated ACA compliance issues is related to Sue Tiede’s letter to the aides and paras.

I encourage you to read the letter below, draw your own conclusions and welcome your comments on Community Matters.. Please share the information with District parents, particularly those parents (and their children) who rely on the services of these targeted District employees. On the offside chance that School Board members are unaware of Sue Tiede’s letter to the aides and paras, I will email them a copy of this post.