The countdown is on for the final approval of the TESD 2021-22 budget. At the finance committee meeting on Monday, June 7, 7 PM, the budget specifics will be reviewed, and the school board will vote on the District’s 2021-2022 final budget and property tax rate at the June 14 regular board meeting.

The countdown is on for the final approval of the TESD 2021-22 budget. At the finance committee meeting on Monday, June 7, 7 PM, the budget specifics will be reviewed, and the school board will vote on the District’s 2021-2022 final budget and property tax rate at the June 14 regular board meeting.

It is unclear why the upcoming finance committee meeting on June 7 remains virtual but that the school board meeting on June 14 is in-person at the high school!

In early 2021, the school board voted to approve a resolution certifying that the tax increase for the 2021-22 budget will be 3% or lower. Should the District’s final 2021-2022 budget include any tax increase, it would mark the 17th straight year of tax increase to its residents.

As the 2021-2022 budget process moved forward this year, there are board members committed to a zero tax increase – most notably Scott Dorsey. On flip side, there are school board members who favor the highest tax increase possible. Although Scott has championed the zero tax increase cause during his tenure on the board, he (and the taxpayers) never enjoyed majority support.

To watch the video of the May finance committee meeting, click here. About three hours into the meeting (watch at 3.04.40 – 3.04.50) a finance committee member comments that the state says we are “not taxing enough” to our residents. All I can say is thank goodness for the Act 1 index which limits our maximum tax increase.

We saw what happened last year – amid the pandemic most of the board ignored the public and voted instead for a tax increase! Will the vote on June 14 finally break the cycle of the annual tax increase? We’ll know in a couple of weeks, and in person!

For those of you that follow Community Matters, you will recognize the name Keith Knauss as a regular contributor. Keith is a former school board director of Unionville-Chadds Ford School District, serving for many years, several as its president. UCFSD and TESD share striking similarities in rankings, test scores, etc. As a result, Keith follows our District, particularly its budget process and sent a detailed email regarding finances to the TE School Board last week.

Keith provided me a copy of his email titled “District Financial Programmatic Decisions Based on Quicksand” offering that it could be shared on Community Matters (see below). His message is clear and direct to the school board but will it make a difference? Keith points out that all deliberations, by law, must be made in public so that the public can provide feedback. Wouldn’t it make sense to have the June 7 finance committee meeting in person!? Did any of the school board bother to respond to him?

District Financial and Programmatic Decisions Based on Quicksand

To: TE School Directors

From: Keith Knauss

This note may help you with your current budget deliberations.

Each year your administration presents the board with revenue and expense numbers for the upcoming school year. They are supposedly their best estimates of revenues the district will collect and the expenses that will be used for the education of the children over the next fiscal year. Your job, which you’ve already begun, is to bring the budget into balance by either cutting programs to reduce expenses or increase revenue by either increasing taxes and/or user fees. Your deliberations, by law, must be made in public so the residents can provide feedback.

- Currently, you and the public have been presented with budgeted revenues (before any tax increase) of $150.2M.

- You and the public have been presented with budgeted expenses of $156.7M.

- That leaves you with a $6.5M hole to fill to achieve a balanced budget.

- That’s a pretty large hole to fill and the situation cries out for you to raise taxes to the maximum amount allowable (3%) to bring in an additional $3.6M to partially fill that $6.5M hole.

- In the end, after raising taxes by 3% you’ll close the budget gap by using $3M from your savings account which is officially called the Fund Balance.

In summary: The administrators, using their wisdom and experience, supposedly gave you and the public

their honest estimates of revenues and expenditures for the next fiscal year. You are deliberating before the public on tax increases, user fees, program cuts and use of savings based on those budget numbers.

But what if the administrators are not very good at estimating or, worse, are purposefully presenting a false financial picture? What if the administrators have a history of underestimating revenues and overestimating expenses so as to present a bleak financial picture scaring the board and public into either cutting programs, instituting user fees and/or taking the maximum tax increase possible?

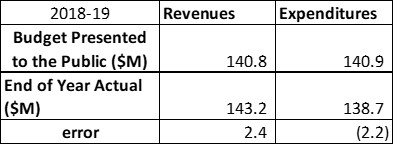

To see if there is any evidence of previous fictitious budgeting we can examine the latest two independent financial audits – 2019-20 and 2018-19. The audit is the only place where the budget numbers used to justify taxation are placed side-by-side with actual year end results. How did the administrators do in 2018-19?

As can be seen from the graphic above, budgeted revenues were underestimated by $2.4M and budgeted expenses were overestimated by $2.2M for an aggregate error of $4.6M. To put the $4.6M error in perspective, that year’s tax increase of 2.4% brought in an extra $2.6M. If the board and public had better budget numbers they could have contemplated a lower tax increase, no tax increase or even a tax decrease.

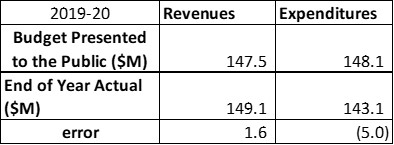

How did the administrators do in 2019-20?

As can be seen from the graphic above, revenues were underestimated by $1.6M and expenses were overestimated by $5.0M for an aggregate error of $6.6M. To put the $6.6M error in perspective, that year’s tax increase of 2.6% brought in an extra $3.0M. If the board and public had better budget numbers they could have, again, contemplated a lower tax increase, no tax increase or even a tax decrease.

What about this year – 2020-21? The fiscal year won’t be done until June 30th and the audit won’t be

available until December. However, the administration has already indicated their budget numbers will have underestimated revenues and overestimated expenses by at least $1.8M.

Bottom line:

- School directors make taxation and program decisions based on revenue and expenditure estimates supplied by the administration.

- The administration has a history of providing inaccurate revenue and expenditure estimates so as to make informed budget decisions impossible.

- The board should ask probing questions to determine whether the revenue and expenditure estimates for the upcoming fiscal year are a true picture of expected results or whether the estimates are “padded”.

- The board should make the public aware of how inaccurate revenue and expenditure estimates can adversely affect taxation and educational program decisions.

Feel free to contact me for further clarification or comments.

Between the raging pandemic and the horror witnessed in our nation’s capital last week, focus on other matters is hard to come by these days.

Between the raging pandemic and the horror witnessed in our nation’s capital last week, focus on other matters is hard to come by these days.