On the eve of June 1st and days away from the end of school year, the school board still does not have an agreed up tax increase number for the budget! How is that possible? What we do know is that the tax increase will be less than the 6% that we have heard since the middle of December and the increase was approved in the draft final budget. However, we are left with three numbers — 2.8%, 3.91% and 4.33%. Exactly how did the Board come up with these various numbers? What are the numbers based on? And how does the incorrect accounting of the Special Ed expenses factor into the tax increase?

On the eve of June 1st and days away from the end of school year, the school board still does not have an agreed up tax increase number for the budget! How is that possible? What we do know is that the tax increase will be less than the 6% that we have heard since the middle of December and the increase was approved in the draft final budget. However, we are left with three numbers — 2.8%, 3.91% and 4.33%. Exactly how did the Board come up with these various numbers? What are the numbers based on? And how does the incorrect accounting of the Special Ed expenses factor into the tax increase?

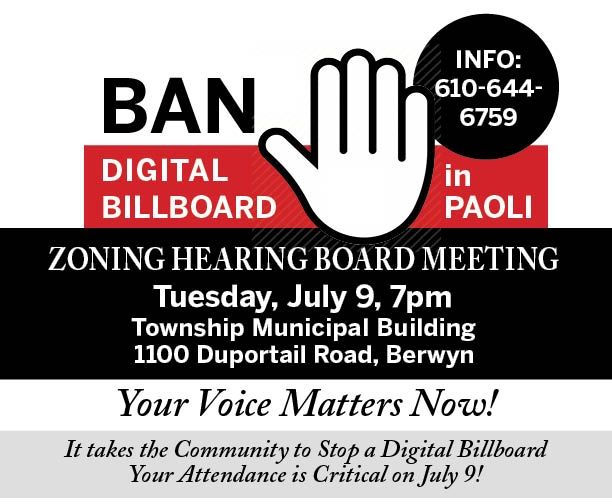

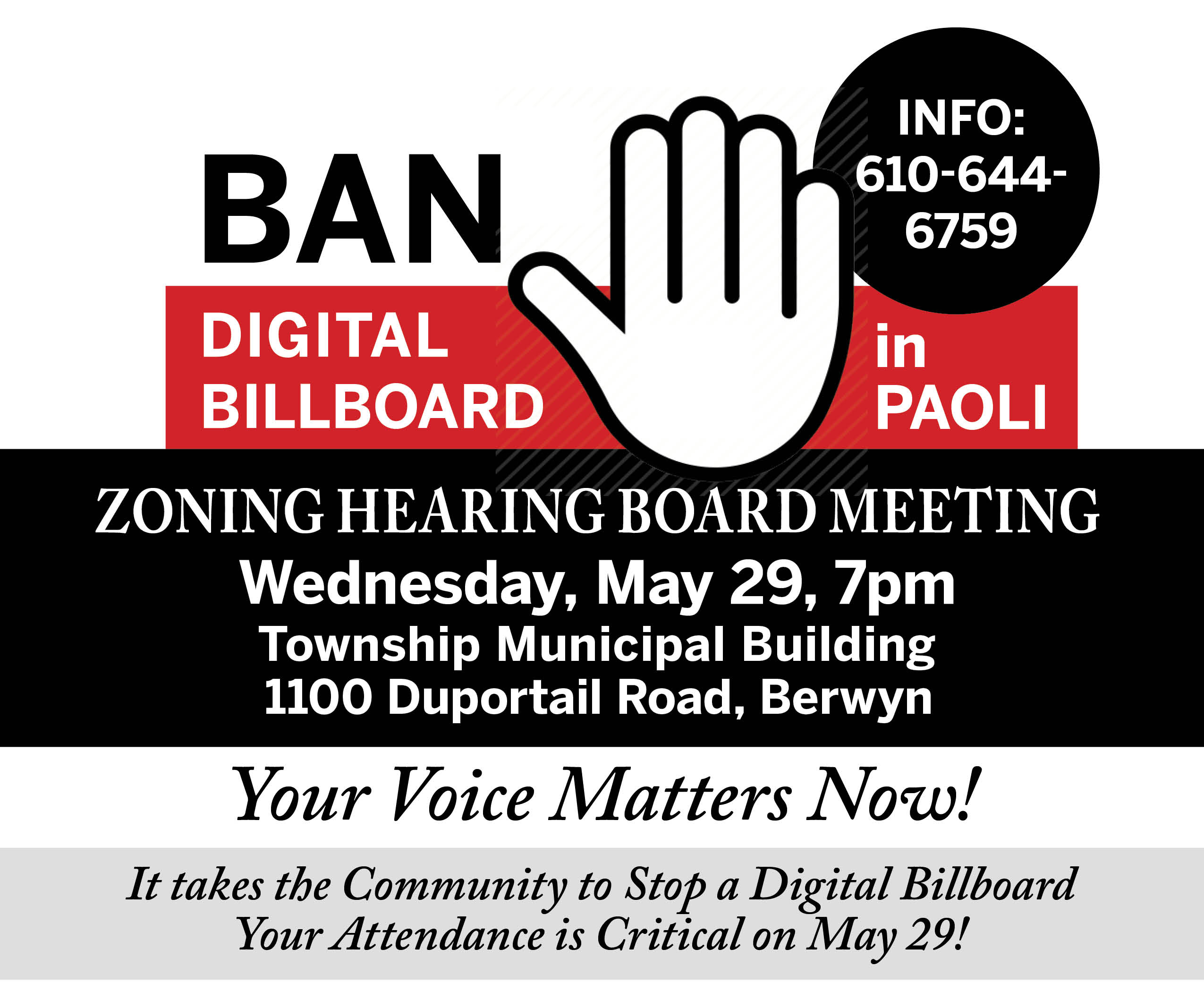

Although I was unable to attend the school board meeting this week because it was the same night as the digital billboard appeal, Doug Anestad attended and offer his remarks below. Plus the video of the May 29 school board meeting is now available on the District’s website, click here to view.

After reading Doug’s comments, my first takeaway is that maybe the TESD 2019-20 budget process should be renamed, “To Be Continued …”!

The school board met Wednesday night. The agenda was very light.

What was interesting was that no new budget discussions happened. It is very late in the game not to come to a final tax rate increase. Therefore, the 2.8%, 3.91%, and 4.33% tax increases are all still on the table.

The board proposed changes to Regulation 2110: Job Responsibilities for Superintendent of School. The proposed change says that if one or more invoices from the same vendor above $200k is accounted for in the wrong fiscal year, the Superintendent must be notified and the Superintendent must inform the school board.

Of course, this proposed change in regulation came about because the administration didn’t tell the the school board about $1.2M in special education expenditures from 2016-2017 that were wrongly recorded against 2017-2018. I spoke about the regulation and said that if you have to tell the administration when $1.2M is misstated they should notify the board, it is not a policy issue, it is a personnel issue and they should treat it as such. Kyle Boyer also had concerns about it being a personnel and not a policy issue. The vote was 8-1 on the regulation change.

When the administration started discussing the launch of updating the Strategic Plan at a cost of $50k, some of the board members raised concerns. This is highly unusual as this item is not even normally voted on as a separate item. Multiple board members said that they thought that the district was not in a position to deal with a Strategic Plan. The final vote was 5-4 with Michele Burger, Kate Murphy, Ed Sweeney, and Heather Ward all voting against the motion. I believe that this close vote demonstrates that multiple board members are not happy with the current situation and the administration.

Major kudos to Ed Sweeney for bringing up the issue of revising the finance numbers for the prior years to be the actual numbers. He asked, and the board agreed, to look into the financial and legal ramifications of fixing the numbers to be the real numbers. They seem to be most concerned about double dipping next year since they already got a higher taxing authorization from the state based on the wrong numbers.

I am not sure why so many on the school board continue to be so hesitant to figure out the truth. Why have they still not asked the auditors when Art McDonnell informed the auditors about the $1.2M account error? Why haven’t they already figured out what the process is to correct the numbers? Why haven’t they asked the state how revising the financial statements to be the real numbers will impact their taxing authority?